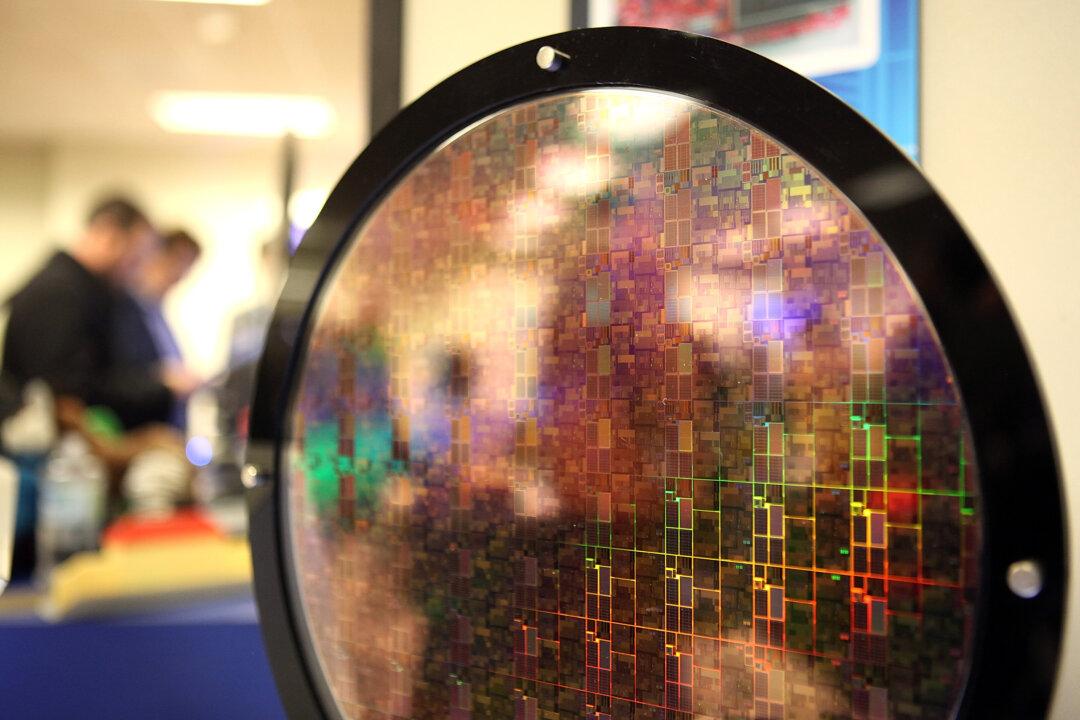

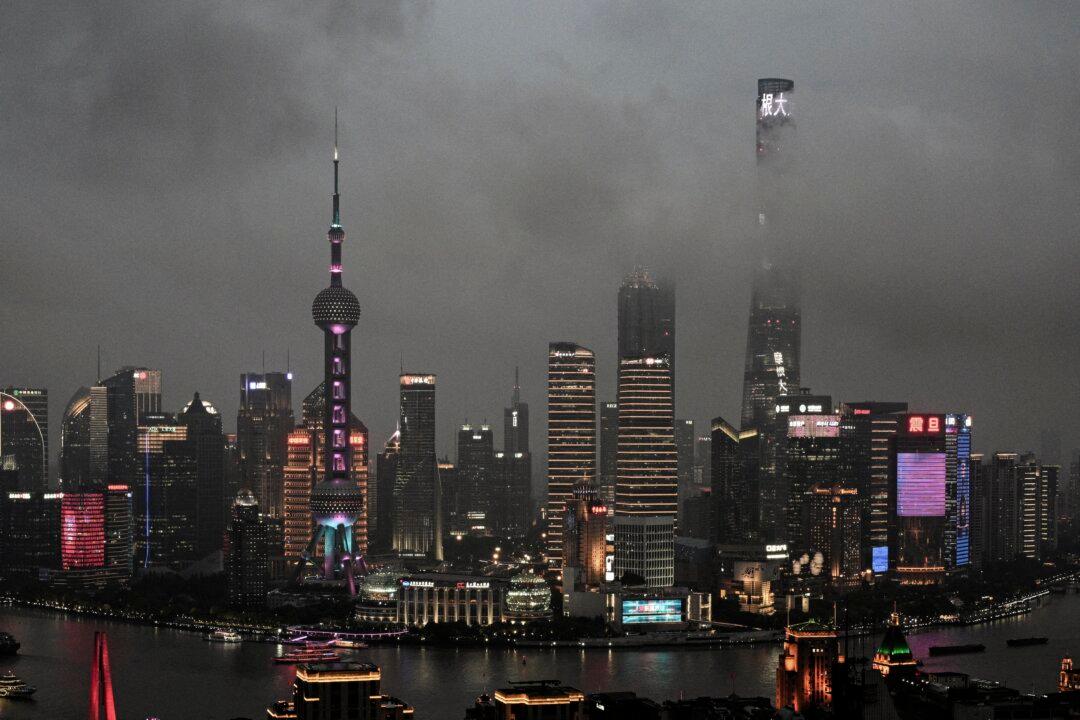

The U.S. National Counterintelligence and Security Center (NCSC) has warned U.S. technology startups that foreign adversaries such as China can use investments to steal their sensitive data and intellectual property, undermining U.S. economic and national security.

In a joint bulletin released on July 24, the NCSC expressed great concerns about potential threats from these investments by “foreign threat actors” and provided guidelines to address these risks.