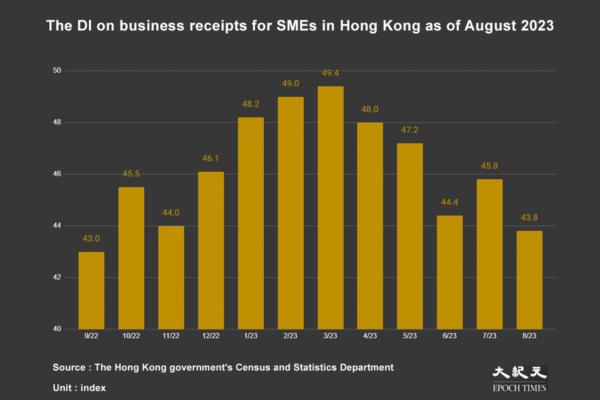

The Hong Kong government’s Census and Statistics Department (CSD) recently released the latest data on the business situation of SMEs. In August, the current diffusion index (DI) on Hong Kong SME business receipts fell by 2.0 points to 43.8 points, marking a new low for the year after the pandemic-related closures, reflecting a weakening recovery. The DI index on employment decreased by 0.3 points to 49.3 points, while the outlook on business receipts dropped by 2.1 points to 47.4 points.

The DI (Diffusion Index) on business receipts for SMEs in Hong Kong as of August 2023. Produced by The Epoch Times