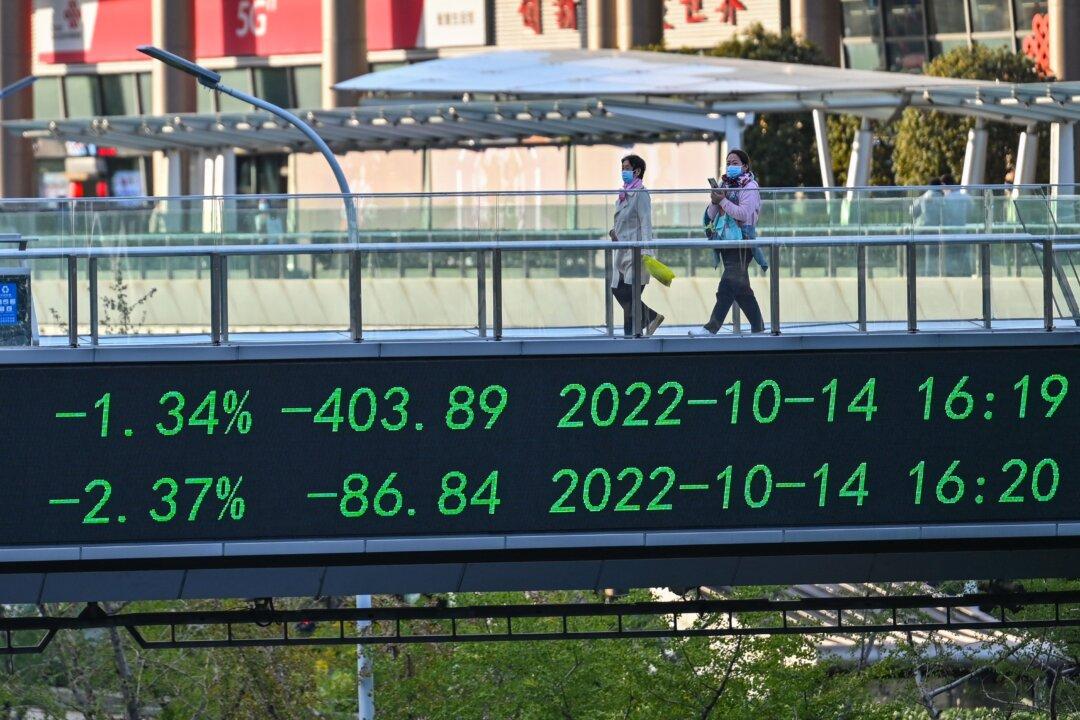

On Oct. 16, China’s A-share market was in shock throughout the day as the three major stock indexes in China fell collectively. The Growth Enterprise Market (GEM) index fell 2 percent, hitting a 3.5-year low. Semiconductor chip stocks, including storage chips, fluorine chemicals, photoresists, lithium, and other new energy track sectors, fell across the board.

The so-called king of China’s new energy tech company, Ningde Times, is a leading supplier of batteries and parts for electric vehicles. Its shares fell more than 3 percent that day, hitting a new low in two and a half years. In August, the company’s stock had risen in price as foreign investors bought into it.