New Analysis

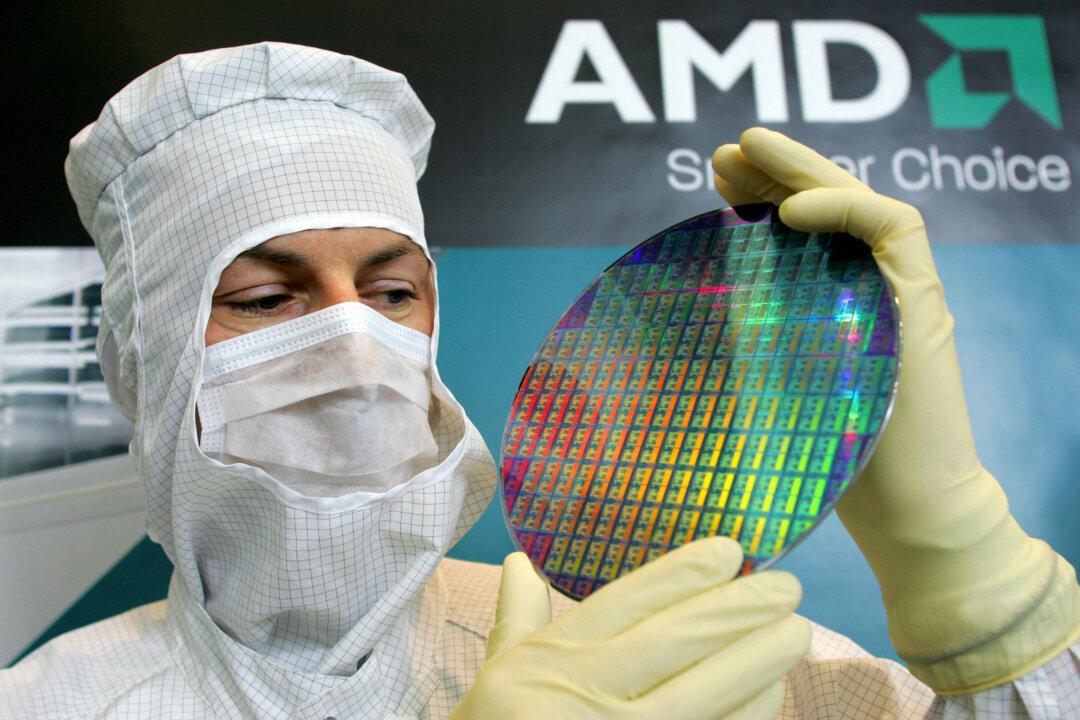

Over the past three years, more tech companies around the globe are aligning with U.S. efforts to decouple from China—a campaign to cut China out of the high-tech supply chain started by the Trump administration.

Over the past three years, more tech companies around the globe are aligning with U.S. efforts to decouple from China—a campaign to cut China out of the high-tech supply chain started by the Trump administration.