China has been buying up agricultural land in the United States for years, a trend that a U.S. lawmaker said must end in order to safeguard the U.S. food supply chain.

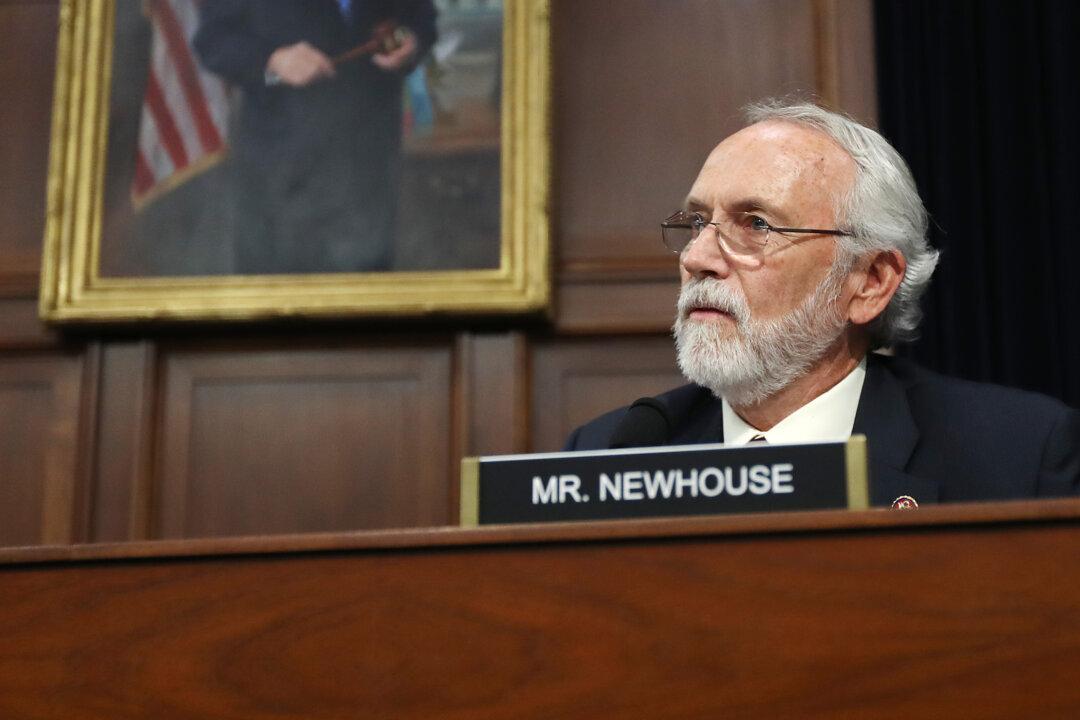

For this reason, Rep. Dan Newhouse (R-Wash.) introduced an amendment to the House’s fiscal year 2022 agriculture appropriations legislation (H.R.4356) in June. In a recent interview with NTD, the lawmaker explained what his amendment would do.