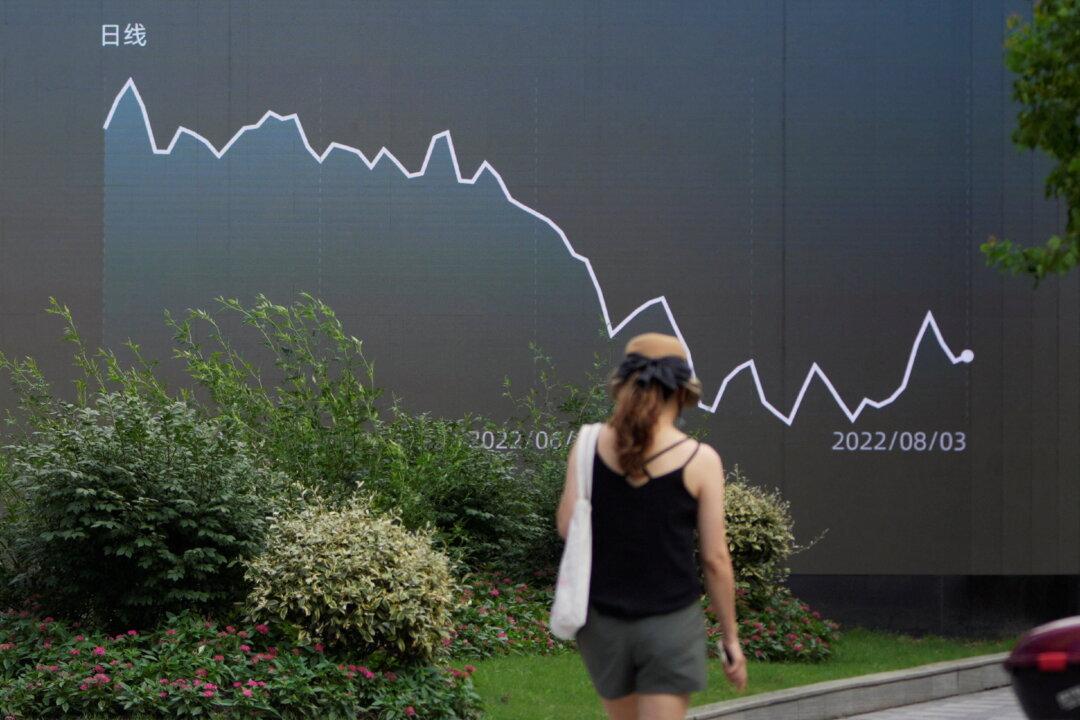

While state-backed buying of Chinese equities since the beginning of the year could drive up the markets from multiyear lows, foreign investors, however, are skeptical about whether “the support will last” and can boost their confidence. The Chinese economy is still struggling, and its fundamentals haven’t changed that much to provide a lasting turnaround and consumer and investor confidence, they say.

The “national team” of Chinese state-backed investors, formed in reaction to a 2015 market disaster, pumped 410 billion yuan ($57 billion) into onshore shares this year to bolster the market, the Zurich-headquartered multinational investment bank and financial services company UBS Group AG said in a client note on Tuesday.