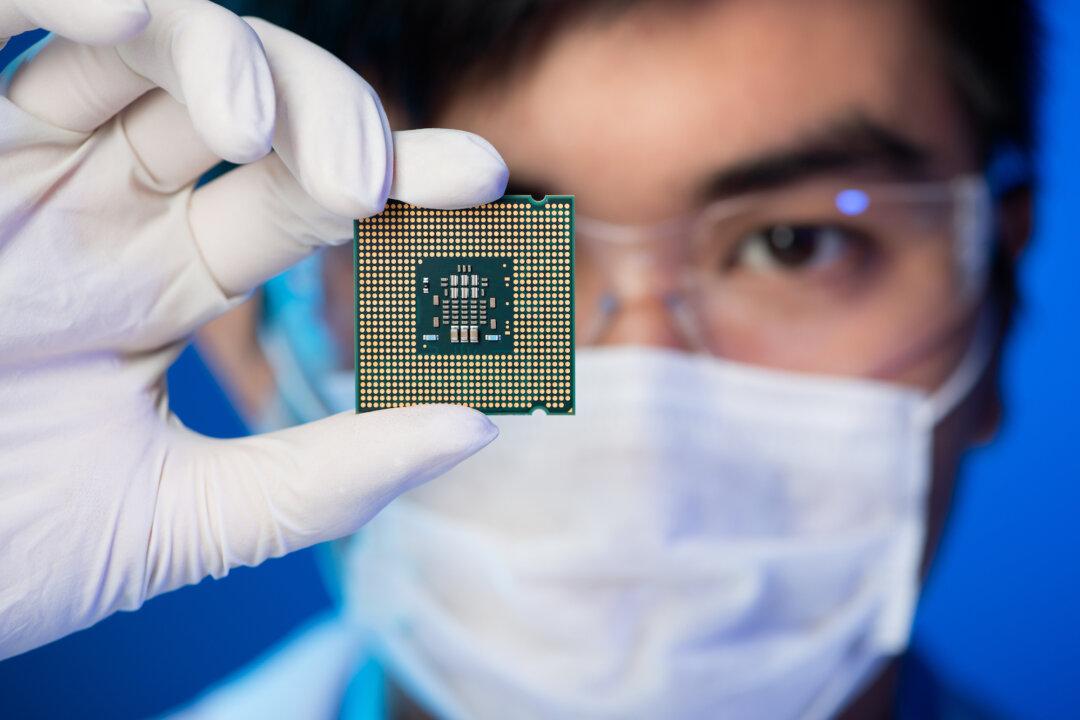

At the heart of the modern economy is the semiconductor, and the United States is the world leader in producing the tiny microchips. Now China is seeking by fair means and foul to challenge America’s preeminence.

A courtroom in San Jose, California, is the latest battleground in this ongoing industrial war. On Nov. 30, four former engineers at Applied Materials Inc., an American firm that supplies equipment and software for manufacturing semiconductor chips, were indicted for stealing chip designs from the company and attempting to use them to set up a Chinese startup, according to Bloomberg.