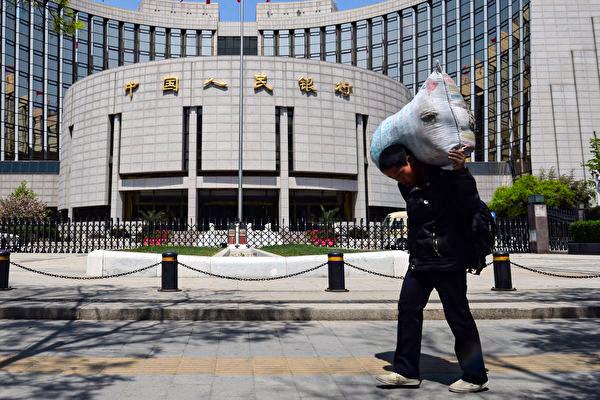

The People’s Bank of China (PBOC) surprised markets by cutting a key interest rate for the second time in 2022 as the country’s economy struggles to grow.

The central bank reduced the rate on its one-year medium-term lending facility (MLF) loans by 10 basis points, from 2.85 to 2.75 percent. The move is aimed at keeping the liquidity of the banking system “reasonably ample.”