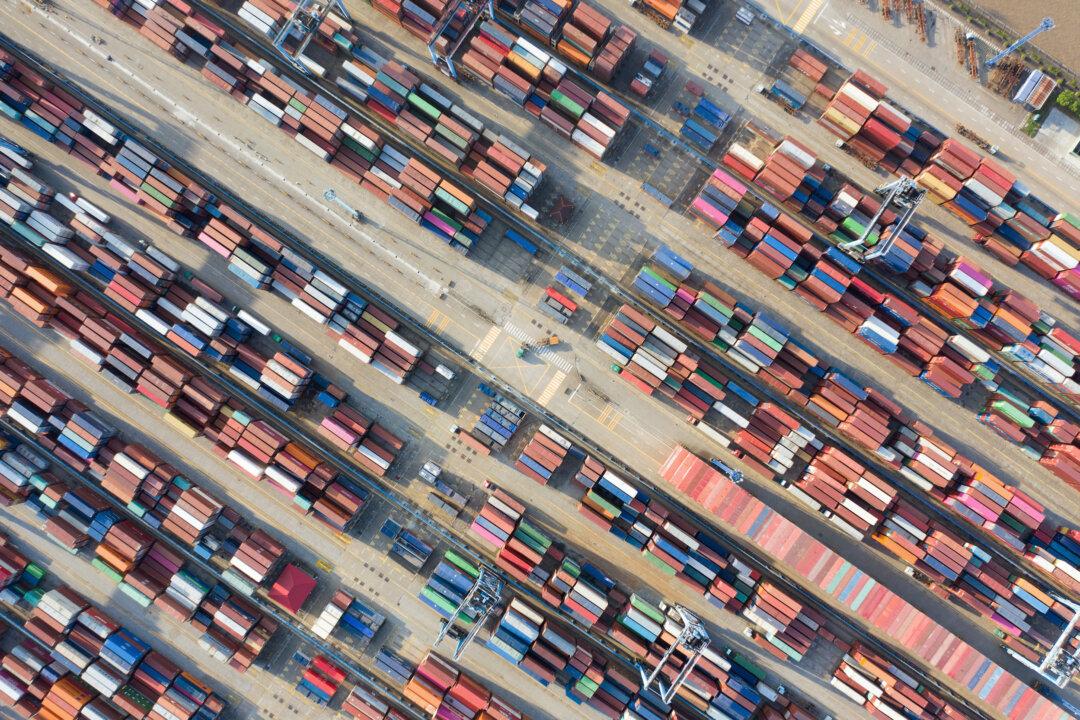

BEIJING—China’s economic growth is expected to slow to a near 30-year low of 6.2 percent this year, a Reuters poll showed on July 10, despite a flurry of support measures to spur domestic demand amid a bruising trade war with the United States.

The median forecast was unchanged from the last poll in April.