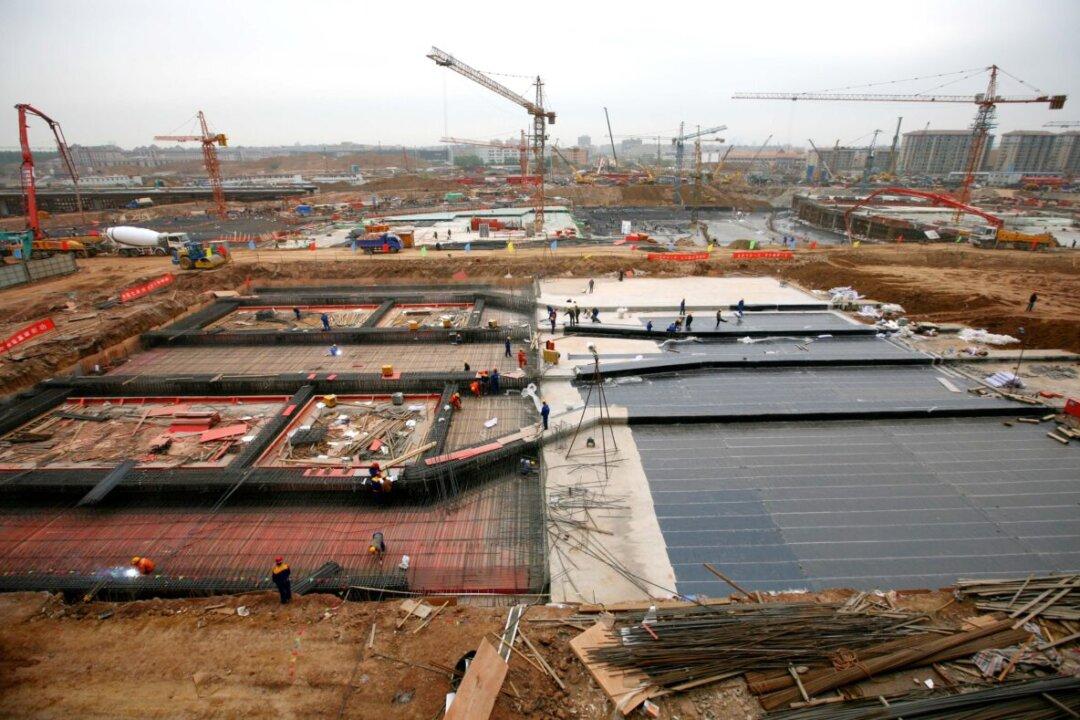

China doubled its investment in major infrastructure projects in the face of downward economic pressure, with total investment exceeding 1 trillion yuan (about $156.8 billion) in early 2022. Given that the country’s infrastructure is close to saturation, such a move might not be effective, a financial source believes.

“Ramping up infrastructure investment is likely difficult to achieve the expected effect of boosting China’s economy,” Albert Song, a senior financial professional focused on China’s political and economic spheres, told The Epoch Times on April 11.