Troubled Chinese electric vehicle (EV) startup WM Motor has filed for bankruptcy, underscoring the difficulties faced in the highly competitive EV market that once positioned it as a rising star in the industry.

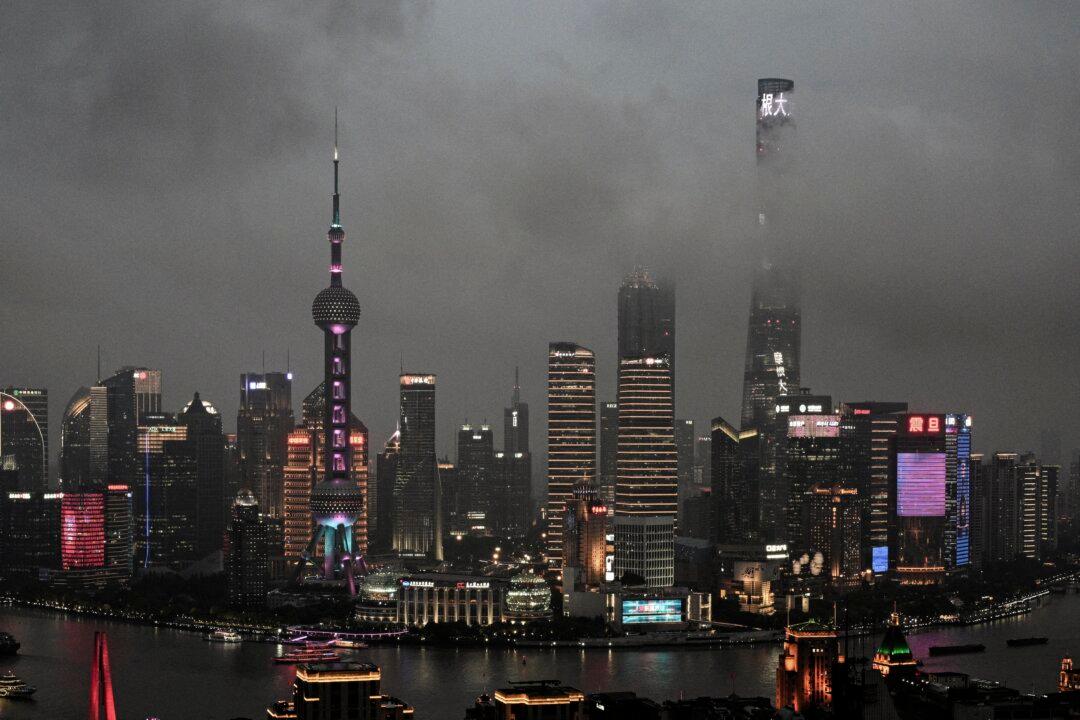

A Shanghai court will review the WM case, according to a filing on the national enterprise bankruptcy information disclosure platform on Monday, Reuters reported.