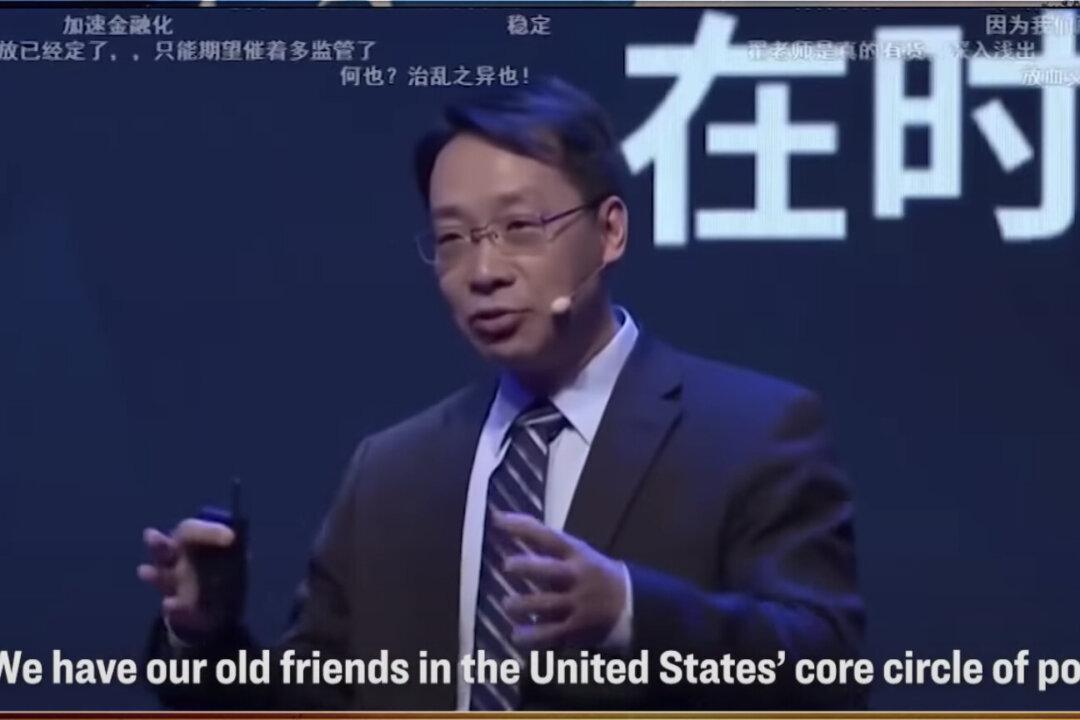

A Chinese professor recently revealed how the Chinese Communist Party (CCP) used their connections or “good friends” in Wall Street to manipulate the United States, politically and financially.

Furthermore, the scholar claimed that the Party was hoping to restore close economic ties with the United States under a Joe Biden presidency.