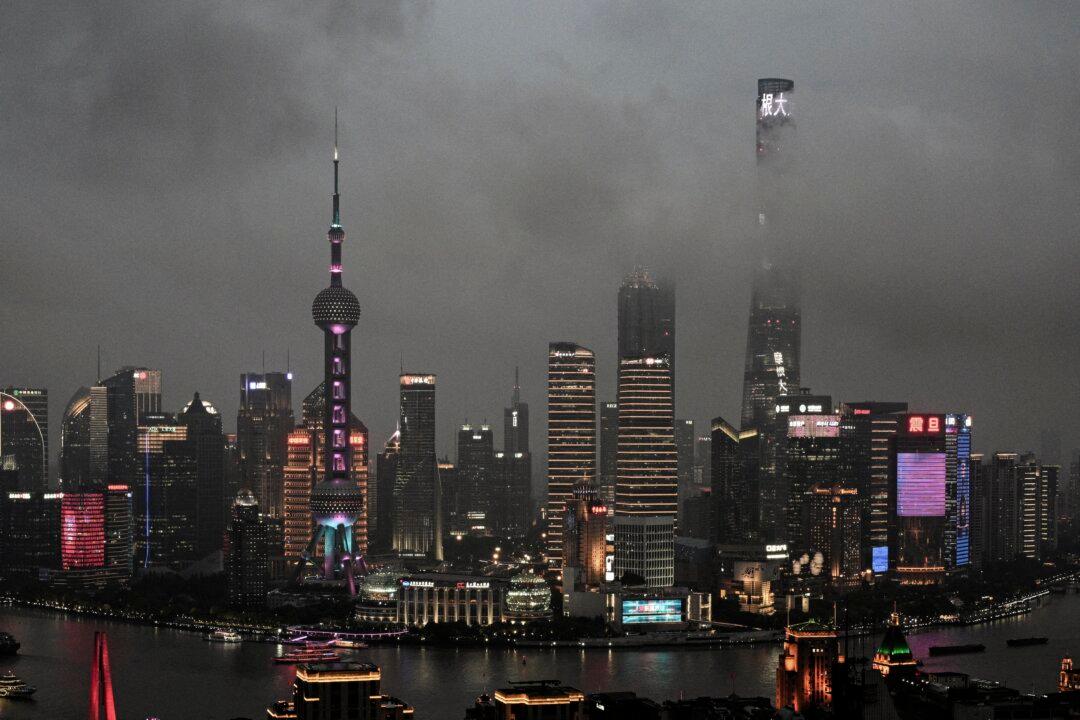

The Chinese economy is in trouble due to its heavy investment in the real estate sector, which could result in a crash worse than the 2008 U.S. financial crisis, a prominent hedge fund manager says.

Kyle Bass, the founder and chief investment officer of Hayman Capital Management, pointed out in an interview with CNBC on Feb. 5 that China’s economic “miracle” mainly relies on real estate to drive growth.