News Analysis

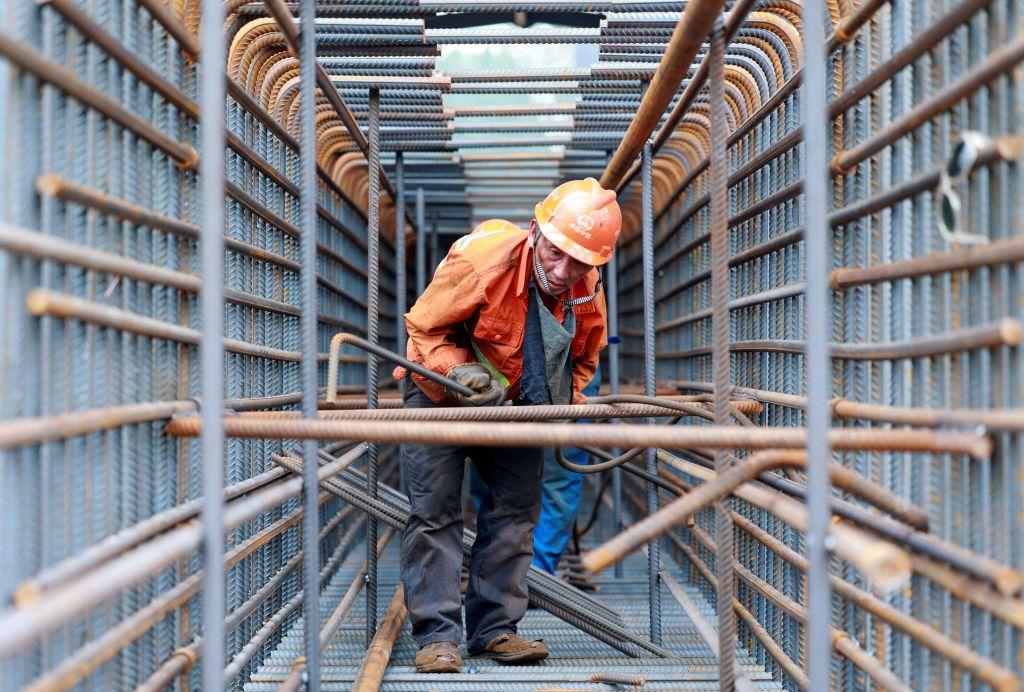

China’s economy is facing its biggest challenge in decades, and authorities are running out of tools in their toolbox to address the issues, according to experts.

China’s economy is facing its biggest challenge in decades, and authorities are running out of tools in their toolbox to address the issues, according to experts.