As the world’s largest consumer of iron ore, China has long relied on imports as the country’s iron ore resources cannot meet its domestic demand.

According to public data from the U.S. Geological Survey, as of 2021, China’s uncovered iron ore resources, including raw and iron-bearing ore, are about 26.9 billion tons, accounting for 10 percent of global reserves.

However, more than 90 percent of China’s iron ore is of poor grade. Its average ore grade, as measured by iron content, is only 35 percent, far lower than Brazil’s 52 percent and Australia’s 48 percent. At the same time, China’s iron ore is buried deep, making the mining costs very high. As a result, Chinese steel companies have to import large quantities of iron ore.

The Chinese authorities have been eager to find alternative sources for the raw material, ever since relations turned hostile with Australia, the world’s largest iron ore supplier, two years ago.

In mid-May, China Mining Network released the geological survey results during the country’s 13th Five-Year Development Plan (2016-2020), which shows that China’s new iron ore resources have dropped by more than 90 percent compared with the 12th Five-Year Development Plan (2011-2015) period.

More specifically, from 2016 to 2020, 23 new iron ore producing areas were discovered in China, with a total resource of 855 million tons. The new iron ore resources were 94 percent lower than those in the 2011 to 2015 period.

The largest new iron ore resource is located in the Shanzhuang mining area in Dong'e County, Shandong Province, with an additional resource of 210 million tons; but the ore grade is low as the iron content does not exceed 30 percent. In addition, in the Zhangjiawa mining area in Laiwu, Shandong Province, and the Zhaojiazhuang mining area in Yuncheng, Shanxi Province, 107 million tons and 186 million tons of new iron ore resources were discovered respectively. But the quality there is also relatively low.

One of the few high-quality mines, discovered in Yucheng, Shandong Province, has an iron content of about 69 percent, but the total reserve is merely 15 million tons. Another iron-rich mine located in Golmud City, Qinghai Province, has a reserve of only 26 million tons.

As the top consumer of iron ore, China’s crude steel output was 1.03 billion tons in 2021, according to China’s Bureau of Statistics. Based on the calculation that one ton of crude steel requires 1.6 tons of iron ore, Chinese enterprises should have consumed about 1.65 billion tons of iron ore in 2021. In that same year, the global output of iron ore was 4.2 billion tons, with China’s demand accounting for roughly 40 percent of the global output.

China’s own iron ore production is far from enough to meet the huge demand. In 2021, it was 580 million tons, while its iron ore imports in the same year were 1.12 billion tons.

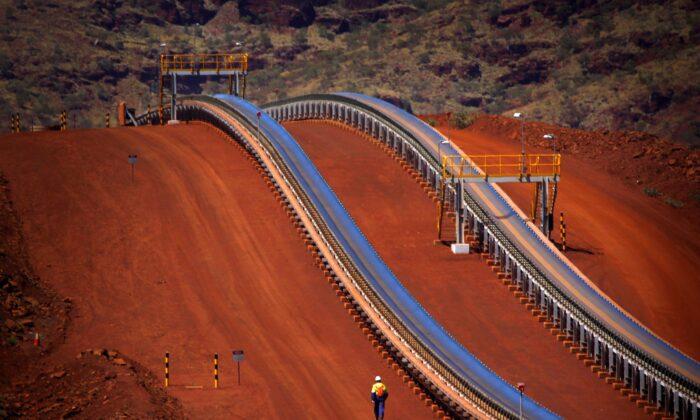

Most of China’s imported iron ore used to come from Australia and Brazil. According to the statistics of Prospective Economist, in 2020, 66 percent of China’s imported iron ore came from Australia, and 21 percent came from Brazil.

However, relations between China and Australia have continued to deteriorate since April 2020, after Australia called for an independent international inquiry into the origins of the novel coronavirus.

In order to reduce dependence on Australian iron ore, in addition to exploring new mineral resources in China, the Chinese authorities have stepped up efforts to acquire more high-quality resources abroad to control the iron ore supply chain, but their plan recently suffered a major setback.

In March of this year, the Simandou iron ore project in Guinea, Africa, which the CCP had high hopes for, was suspended by the local government.

The Simandou iron ore mine has more than 2 billion tons of high-grade—more than 60 percent iron content—iron ore. The SMB-Winning Consortium, a consortium backed by the Chinese regime, won the mining rights to the Simandou No. 1 and No. 2 mining areas in 2019; while the Aluminum Corporation of China owns 40 percent shares of the Simandou No. 3 and No. 4 mining areas.

In September last year, a military coup erupted in Guinea. On March 10 this year, the Guinean military government ordered a halt to all activities at the Simandou iron mine.

The new government said that the first thing that needs to be done is figure out an operation mode that safeguards Guinean interests, and that any developer engaged in mining in the country must build a railway across Guinea.