China’s central bank is continuing its monetary easing policy in 2023 in a bid to stimulate consumption to boost the economy and stabilize the property market, but the real estate market is still falling in most cities. At the same time, data in January showed a continued rise in the country’s infrastructure spending plus a trend among the Chinese population to save money, which means that fewer people are willing to spend money on real estate given the current economic environment.

The mortgage rate for first-time homebuyers in China dropped again in many parts of the country at the start of 2023, and the spread between existing and new mortgage rates continues to widen.

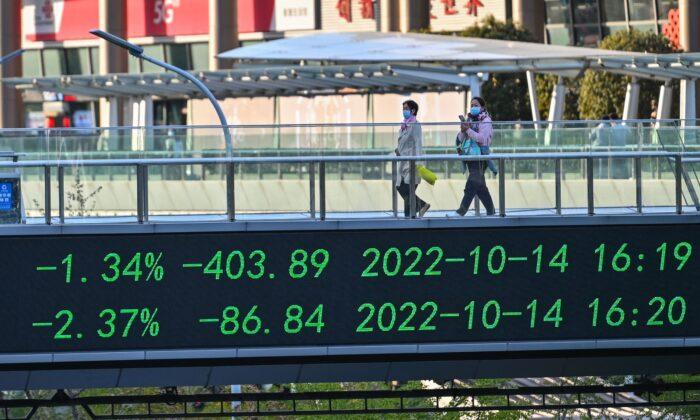

Property prices continue to fall in many cities. On Feb. 16, China’s Bureau of Statistics released data on property prices in January, revealing that prices outside the country’s largest population centers are falling year-over-year.

On Feb. 10,

China’s Central Bank released financial statistics for January, reporting that broad money (M2) grew 12.6 percent year-on-year, while narrow money (M1) grew 6.7 percent year-on-year, with a net cash injection of 997.1 billion yuan (U.S.$150 billion) during the month.

At the end of January, RMB deposits had increased by 12.4 percent year-on-year. The growth rate was 1.1 and 3.2 percentage points higher than that at the end of December and a year earlier. RMB deposits had increased by 6.87 trillion yuan ($1.03 trillion), up 3.05 trillion yuan ($460 billion) from a year before. Among them, household deposits increased by 6.2 trillion yuan (about $930 billion).

Albert Song, a current affairs commentator and expert on the Chinese financial system, told The Epoch Times on Feb.17: “M2 includes deposit data, so one reason for the increase of M2 is the increase in deposits. There is a significant lack of confidence among property developers and homebuyers at the moment.”

The increase in deposits among the Chinese population, coupled with a lack of consumption, is leading the Chinese economy into an idle state, according to Song.

Further, a Feb. 2

report by China Real Estate Information Corp. (CRIC) posits that even with the CCP’s stimulus policies for the property market, homebuyers are reluctant. The report predicts that this will have a significant impact on the Chinese economy, given that real estate constitutes 20 to 30 percent of China’s GDP.

Major Growth in Infrastructure Projects

The amount of new special bonds approved for China’s local governments in 2023 has increased by 50 percent year on year, surpassing 2 trillion yuan (about $300 billion) for the first time. Local government special bonds are an important source of funding for major local infrastructure projects in China.

Provinces across China have announced their lists of key infrastructure projects for 2023. On the national level, state-owned China Railway announced its railroad construction targets for this year, planning to start construction on more than 1,800 miles of new lines, which include over 1,500 miles of high-speed rail. In addition, several of China’s large state-owned enterprises indicated at their annual work meetings that they will accelerate the construction of major projects to increase the market share of state-owned enterprises.

Spending Key to Economic Recovery

China’s total social financing (TSF) at the end of January 2023 was 350.93 trillion yuan ($52.6 trillion), an increase of 9.4 percent year-on-year, which is the slowest pace since 2017. In China, TSF is a broad measure of credit and liquidity in the economy. TSF includes off-balance sheet forms of financing that exist outside the conventional bank lending system, such as initial public offerings, loans from trust companies, and bond sales.

The significant increase in the size of social finance is accompanied by a significant

increase in the volume of China’s quasi-money—assets such as savings accounts, CDs, and money market accounts—suggesting that people have been more inclined to save, particularly during COVID-19 lockdowns, and that money is not entering the investment arena.

China’s economic recovery hinges on whether consumers start spending those savings, according to a Feb. 15 report from the

East Asia Forum, an international policy forum. However, whether they will do so remains to be seen.