He posits that the Middle Kingdom is dealing with its own veritable economic crisis, a statement many find difficult to accept. “China has hoarded its U.S. $1.9 trillion in reserves. The nation needs to replenish its bank reserves, because many of China’s banks are facing bankruptcy. That is why I think China’s dollar reserves will not play any significant role in the international financial market.” Dr. Rudolph is a lecturer at Ludwigshafen’s Institute of Economics in the East Asia Section.

These remarks came during an interview with The Epoch Times Germany. Dr. Rudolph envisions a similar development to the recent subprime loan crisis period in the United States, only somewhat slower. He does not believe that Chinese banks did not take a hit from their U.S. investments during that period. “The Chinese have gambled for years: first with the Chinese state-owned CIC funds, then with the billions of capital from the now defunct U.S. government mortgage entities Fannie Mae and Freddie Mac, also Morgan Stanley, and in Europe the insolvent Fortis Bank.”

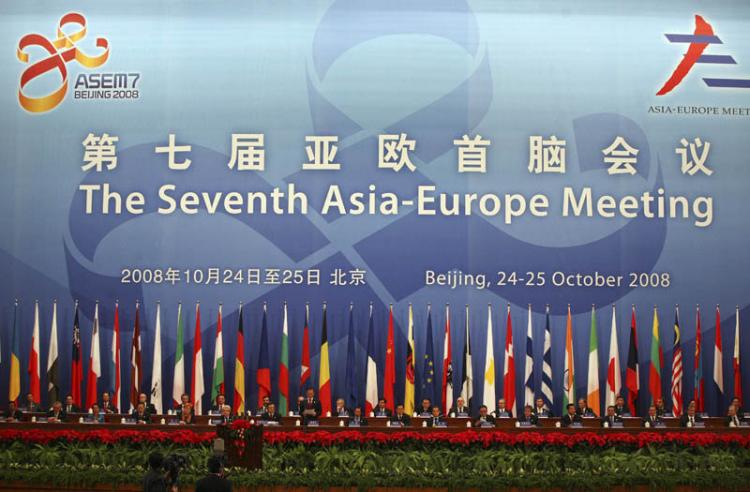

Epoch Times (ET): Chancellor Merkel is presently in China. What role will China play during the ASEM Summit and the discussions relating to finance reform?

Joerg Rudolph (JR): I believe China cannot play any role, at least not the kind of role many would expect because China has her own economic crisis, long in the making. I have no illusions that Chinese institutions will contribute anything positive to the worldwide financial dilemma.

ET: Not even with her huge reserves?

JR: Those reserves are supposed to amount to 1.9 trillion dollars, right? Those are largely invested—$1 trillion in the United States and Europe, in the stock markets or in treasury debt. Much of this money is needed in China to resupply its banks; for instance the virtually bankrupt Nong Ye Yinhang (Agricultural Bank of China). I hold no hopes for those reserves to contribute anything positive to alleviate the crisis, or solve it. All the money has been invested.

The Chinese regime, or the Politbureau, or whoever makes the decisions, cannot simply stash the money somewhere. And there is another consideration: the Chinese CIC fund has invested heavily on the international market the past few years, for instance with Morgan Stanley, and Belgium’s Fortis Bank. The fund saw huge losses, and I would not be surprised if they had actually invested with Lehman Brothers, too. No one in China would now dare to repeat those mistakes—a politically unwise move.

JR: That is difficult to say. We know that China had invested US$400 billion in mortgage entities Fannie Mae and Freddie Mac. They are now government-owned, or they would have gone under. That would mean the billions of dollars the Chinese invested would be down the drain.

ET: Did this conversion to U.S. state ownership happen because of pressure from China?

JR: That is easy to assume, right? U.S. politics and the Chinese Party, the regime, have a symbiotic relationship and have to rely on each other, that is the reason for their friendly relations. The Chinese regime had invested much money in the United States and had financed America’s debt. They cannot simply write off these loans, because the Chinese regime has a vital interest in keeping the American economy afloat. After all, the American and European markets are crucial outlets for Chinese goods; they are co-dependent in this case. They won’t risk offending each other or resort to something irrational. That is the reason we must assume they will continue to discuss ways to find a common solution to this crisis.

ET: The talk is of so much money, but hardly anyone seems to fathom what this could entail. They are simply huge numbers.

JR: And that is not all, new things are developing all the time. The next problem on the horizon is U.S. credit card companies. These firms have amassed huge amounts of debt, US$900 billion, according to the FAZ (Frankfurter Allgemeine Zeitung, a highly respected newspaper). Those debts were resold to other investors who again sold them further. As soon as the credit card companies stop making payments, we will have the next dilemma facing us.

ET: This seems to be an old, ongoing problem. Why won’t people recognize this?

JR: They don’t! And who will eventually pay? You and me (laughing), the tax payers! There is an economic principle: start a large wheel turning, and when it hits a brick wall, others will have to deal with the problem. We know this from banks, when someone is 10,000 Euro in debt and can’t make payments, then the borrower has a problem. But when someone is ten million Euros in debt, then it becomes the bank’s problem.

As for China, one only has to look around to be hit in the face by China’s multifarious problems. Scores of Dongguan enterprises are declaring bankruptcy [on a daily basis]. People are laid off and/or have not received their wages for several weeks.

I have heard that China’s treasury is allocating the equivalent of US200 million to construct rail lines in China, to provide people with employment. China is facing huge economic problems.

ET: What problems are those?

JR: Once European and American consumers no longer buy the many manufactured items imported from China—and all events point in this direction—then China’s problems magnify. Why buy goods people for the most part no longer needd anyway, a third cake server for the Black Forest Cherry Torte, for instance? People are no longer interested in buying those things. And when we no longer need these imported products, China’s problems will become acute.

I don’t want to call it China’s leadership, because I doubt very strongly that these people “lead” anyone, but those who have the power must face huge, varied problems on their own turf. The rulers want to keep things calm and controlled and don’t want to have to deal with international events. I am convinced that the Chinese political elite and most Chinese citizens are under the impression that the ‘bad Westerners, those imperialists,’ are only interested in getting their hands on Chinese riches and money (laughs) and are only out to cheat China. The Chinese love conspiracy theories, more so than anyone else. So, to sum it up, don’t expect any help from China!

ET: What does this mean for Chinese banks that have invested in defaulted U.S. loans that escaped scrutiny from supervisory organs?

JR: All Chinese banks are bankrupt! The regime is in the process of pumping the equivalent of US$20 billion into the system, particularly the Agricultural Bank of China, as I previously mentioned. But where does the money come from? Are they printing new paper, or what?

ET: To once again refer to the reserves, can anything be done with those?

JR: The Chinese are unable to utilize those in China proper because they are derived from exports. That money is in the form of Euros or Dollars and returns to China when they are exchanged for yuan. The China Central Bank sits on Dollars and Euros, which has entered the economic system again in the form of yuan, meaning all the money has returned to the economy. One cannot spend the money as Dollars, unless someone prints their own.

ET: Should this money somehow be spent in the United States or Europe, would this portend higher inflation rates for us?

JR: In the United States it is invested in government debt, but some of it is in Europe, too.

ET: Can anyone put a number to the defaulted loans Chinese banks had issued?

JT: Defaulted loans in China? Much speculation exists. Ernst & Young (an international accounting firm) had published a report, but it met with huge protests, and the company withdrew it. No one knows the actual numbers, but the numbers bandied about were US$900 million. It is difficult to keep this a secret. We must not forget that the Chinese regime lacks any kind of experience [to rule a nation or deal with complicated international matters]. Look at the people, Hu Jintao, and Wen Jiabao. What experience do they have, except how to remain in power! They won’t ever intervene in things like that, given the many losses that are due to their inept actions; it even involves Morgan Stanley, Fortis, and Blackstone.

ET: Word on the street is that Chinese banks suffered no losses at all from the U.S. mortgage credit crunch.

JR: Many things have come to light of late! Of course they gambled, Chinese are gamblers from way back, they love to go to casinos. The same with banks, if there is a bank involved, they simply gamble on a larger scale. We must seriously consider this. We have reliable sources, and were told the Chinese banks have “burned” the money through lavish gestures.

ET: The German media has lately often quoted Hu Jintao’s sentence, “Hope for the future is more important than anything else.”

JR: (Laughs) and morals, don’t forget that! But economic systems everywhere lack morals, not only in China.

ET: Should lack of morals be taken as inevitable?

JR: Any economy is bereft of morality. We are dealing with profit! Nothing breeds more success than success itself. China has to deal with insurmountable problems at present. All of them are rearing their heads at the same time. Steel producers can no longer find buyers, largely because the automobile industry is in a slump. Prices are falling, as you may have noticed.

ET: Yes!

JR: Prices had been on the upswing for years, and now they are falling. The regime had lowered the underwriting criteria and the rulers are now resorting to what the United States had done with their sub-prime loans, the Chinese are following that trend. Once the Chinese middle class can no longer make good on their mortgage or car payments, then a huge dilemma arises.

Note:

Dr. Jörg M. Rudolph (1951) is a lecturer and the director of the East Asian Institute at the School of Economics in the Ludwigshafen. His area of expertise focuses on Chinese history and geography and extends to current political and economic developments. He is publisher of the China Service Sju Tsai - The World of the Chinese (www.xiucai.oai.de). He was a delegate for German Economic Interests in Beijing between 1997 and 2002, and a founding member of the German Chamber of Commerce in China. He studied Sinology at the East Asian College at Berlin’s Free University between 1974 and 1979.