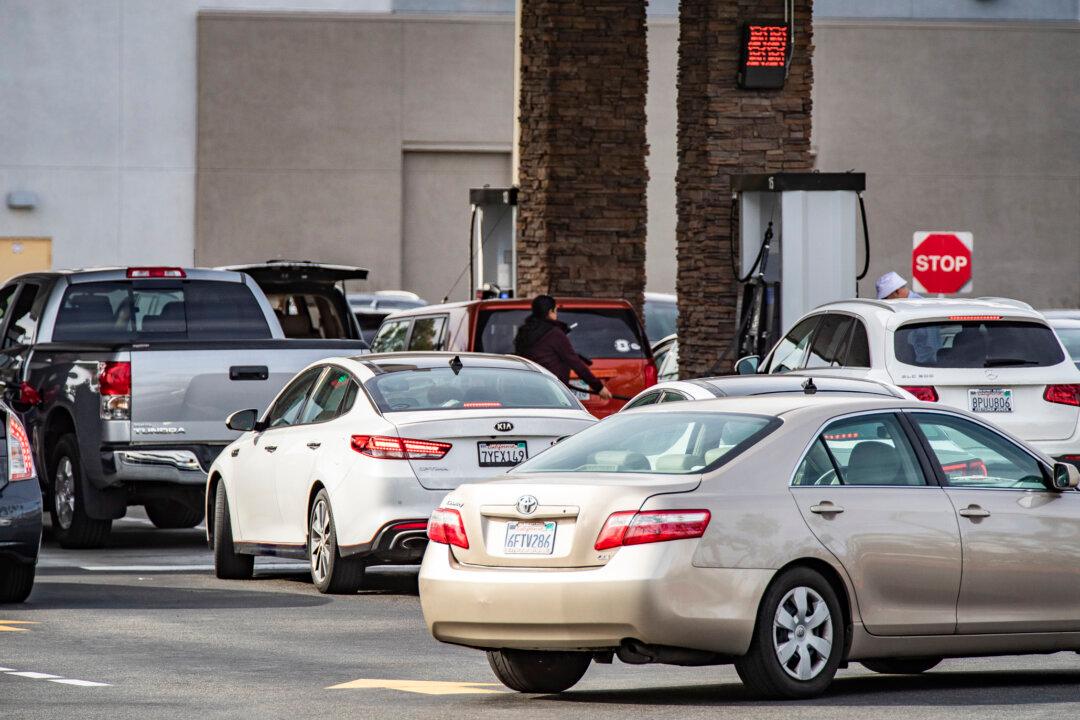

California Gov. Gavin Newsom proposed Jan. 10 to suspend the state’s annual gasoline and diesel tax increase for at least a year, in an effort, he said, to help motorists already paying the highest gas prices in the country.

The proposal would mean the state would skip its July 1 tax hike on gas, which has occurred every year since the passage of Senate Bill 1 in 2017—a tax on gas to raise $5.4 billion annually to repair the state’s highways, bridges, and more.