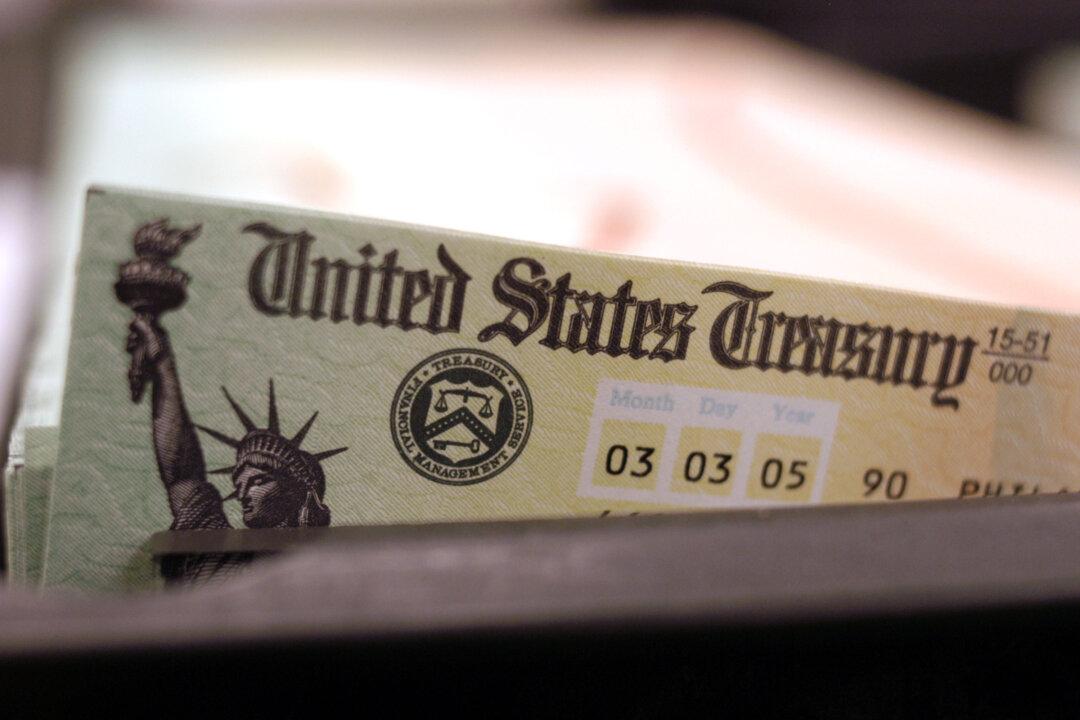

Every single day, I get emails from readers that say things like this: “My wife and I are getting SSI. And we would like to ask you some questions.” Or this: “My SSI check is $2,140 per month. My wife’s SSI check is $1,800. Can she get any of my SSI?”

You know the uncomfortable feeling you get when someone scratches their fingernails on a chalkboard? Well, that’s how I feel when I get emails like this. Why does this bother me so? Because these folks are not getting SSI. They are getting Social Security benefits. And there is a HUGE difference, which I will explain.