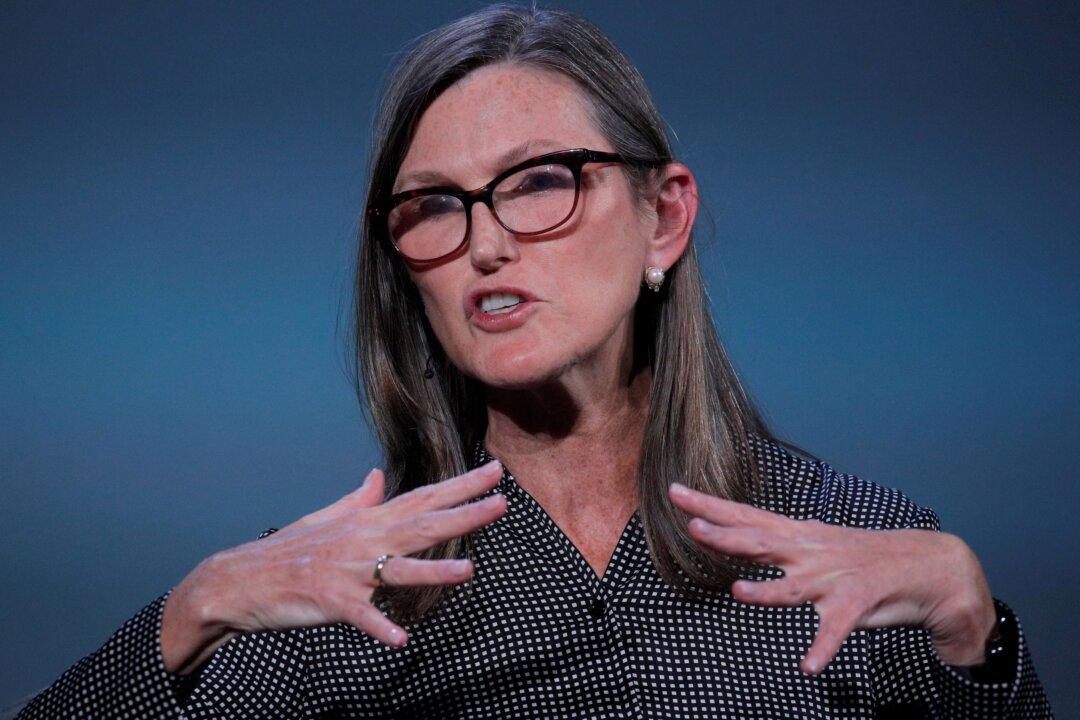

NEW YORK—One year after her Ark Innovation ETF than doubled and made her a household name, star stock picker Cathie Wood is poised to join a small club that no one aspires to be a part of: portfolio managers who have seen their funds go from first to worst in the span of 12 months.

The $16.7 billion exchange-traded fund is on pace to end the year down nearly 24 percent, leaving it one of just 2 actively-managed equity funds tracked by Morningstar to post more than a 20 percent decline this year at a time when the benchmark S&P 500 is up slightly more than 21 percent.