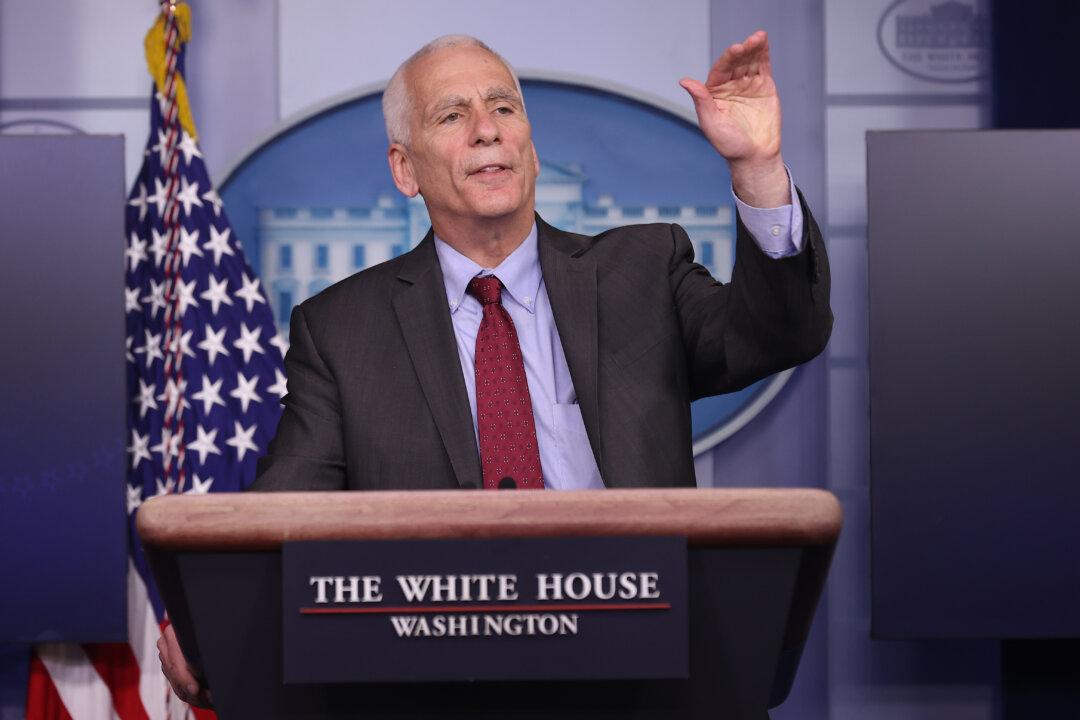

White House economic adviser Jared Bernstein told Fox News in a recent interview that inflation is likely to stay elevated longer than previously expected.

Bernstein told the outlet that he thinks the rate of inflation will come in at around 4 percent for 2021, before falling to 2.3 percent in 2022. He did not say when, precisely, he expects the rate will tick down next year, but noted inflation would likely stay high into the middle of next year.