U.S. firms’ purchases of computer chip-making machines from Taiwan rose to a record high in March as the United States continues to rebuild its domestic semiconductor industry.

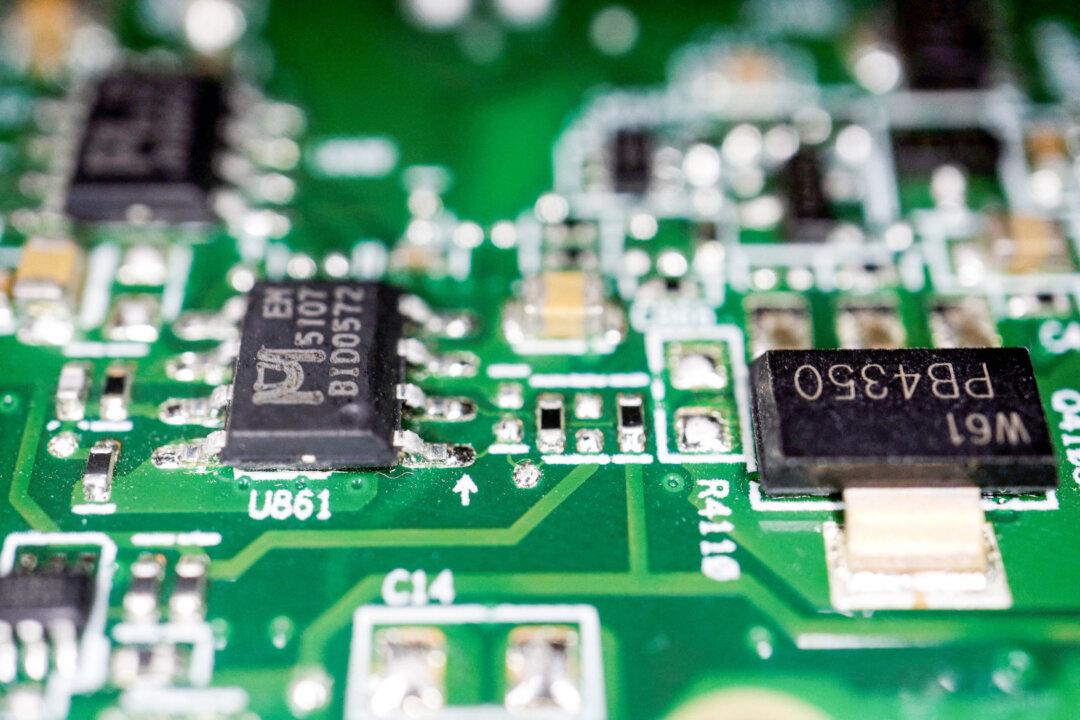

Taiwan Semiconductor Manufacturing Co. (TSMC) and several other major producers in Taiwan are vital players in the global supply chain of computer chips.