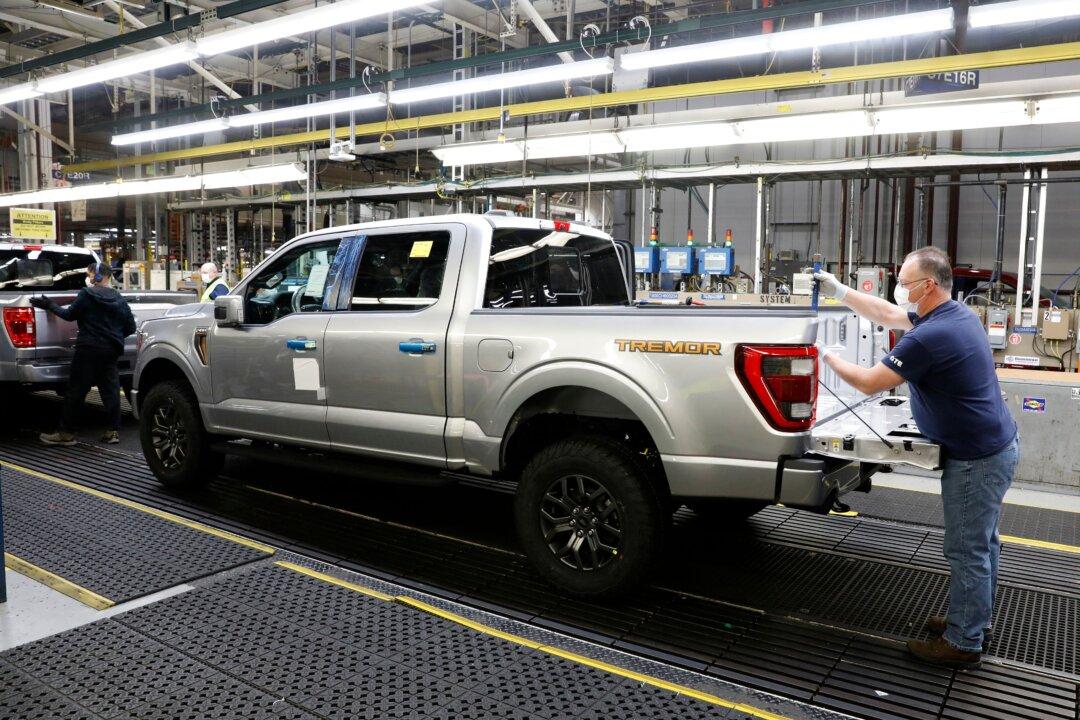

WASHINGTON—Production at U.S. factories increased moderately in January as motor vehicle output fell for a second straight month amid an ongoing global shortage of semiconductors.

Manufacturing output gained 0.2 percent last month after dipping 0.1 percent in December, the Federal Reserve said on Wednesday. Economists polled by Reuters had forecast factory production rebounding 0.3 percent. Output increased 2.5 percent compared to January 2021.