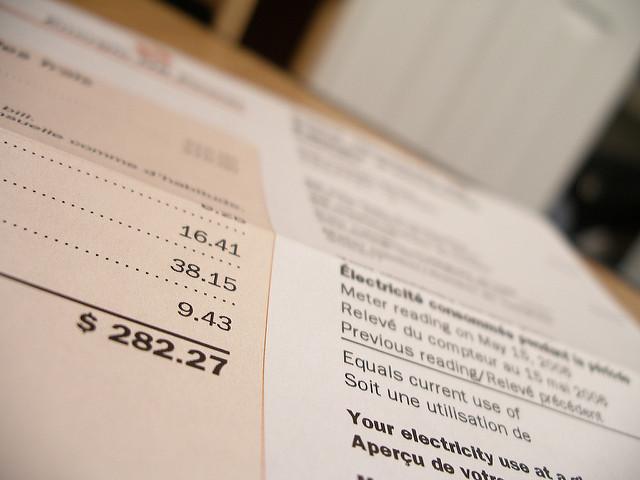

Utility costs have surged across the nation this year, leaving millions of Americans falling behind on their monthly bills. It might get more challenging as households nationwide can expect to pay higher utility costs for decades to come due to storm recovery bond charges.

Natural disasters have ravaged the United States in recent years, from hurricanes to winter freezes. These weather events have destroyed infrastructure and cost electric and gas utility firms billions of dollars in repairs and maintenance.