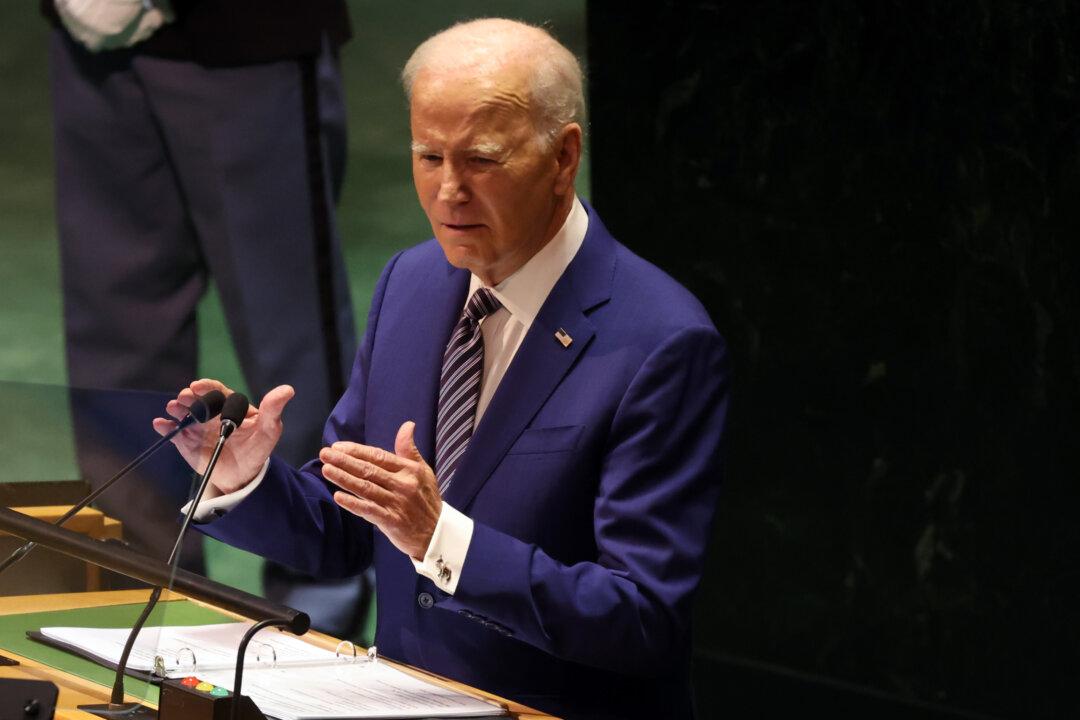

The total national debt of the United States surpassed $33 trillion for the first time in history, with criticism mounting against the Biden administration for its “reckless spending” policies.

Total U.S. debt was $33.04 trillion on Sept. 15, according to data from the U.S. Treasury Department. This is a rapid buildup given that on June 15, total U.S. debt was at $32.04 trillion—indicating that debt rose by $1 trillion in a span of just three months. While the gross national debt exceeded $33 trillion, “debt held by the public, meanwhile, recently surpassed $26 trillion,” Maya MacGuineas, president of government watchdog Committee for a Responsible Federal Budget (CRFB), said in a Sept. 18 statement. “We are becoming numb to these huge numbers, but it doesn’t make them any less dangerous.”