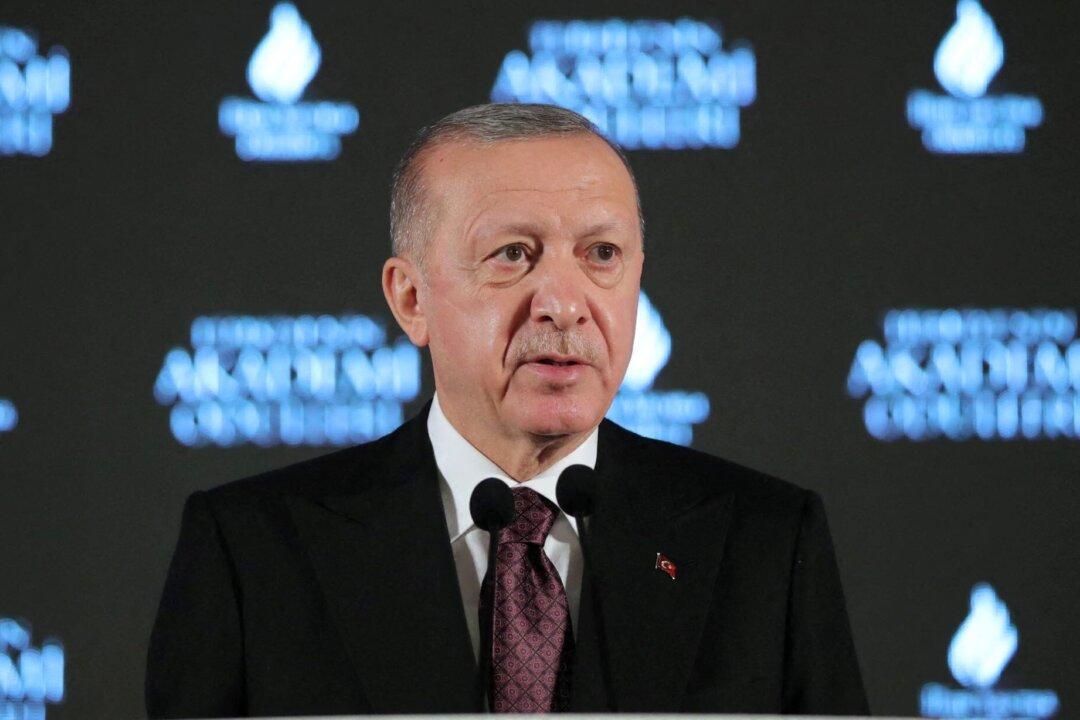

The Turkish Lira slid against the dollar yet again on Monday amid ongoing investor concerns over President Tayyip Erdogan’s monetary policy.

The decline follows a rollercoaster ride of volatility that saw the currency surge more than 50 percent last week after the country’s government announced a number of measures to safeguard deposits held in lira against currency fluctuations.