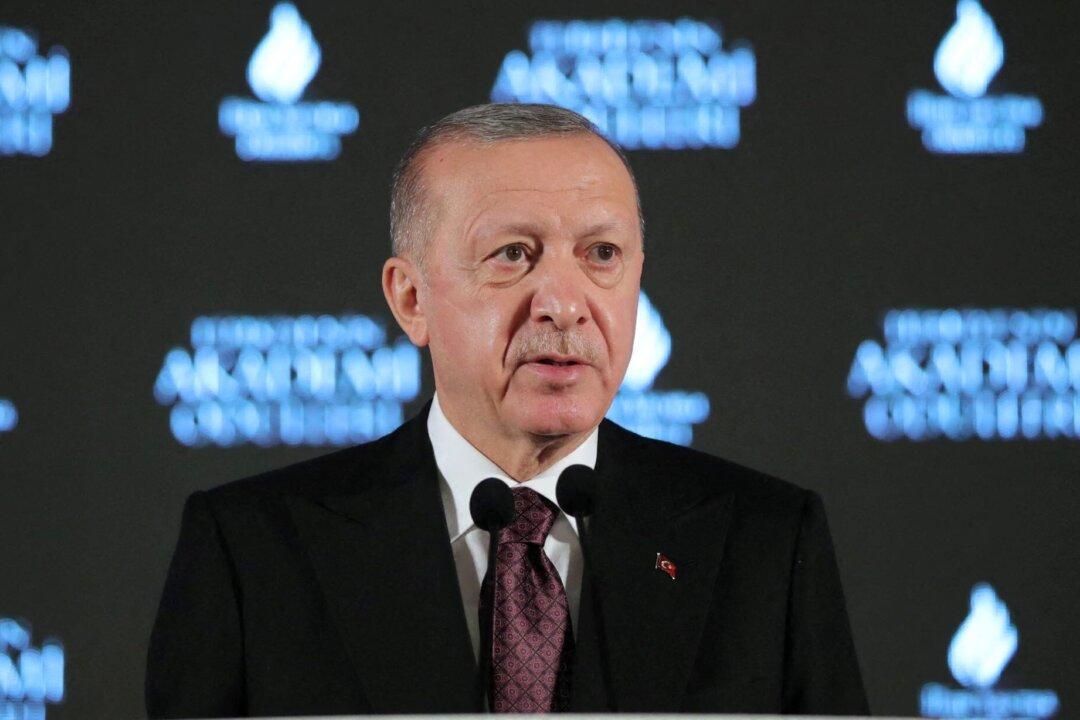

ANKARA—President Tayyip Erdogan said he had lowered Turkey’s inflation to around 4 percent before and that he will achieve that again, as it topped 21 percent following a push for aggressive cuts in interest rates that he has engineered.

Erdogan has said that policy, which has sent the country’s lira crashing, was part of a successful “economic independence war.”