Millions of Americans are heading to polls, with many seeing the struggling state of the U.S. economy as their primary concern for Election Day.

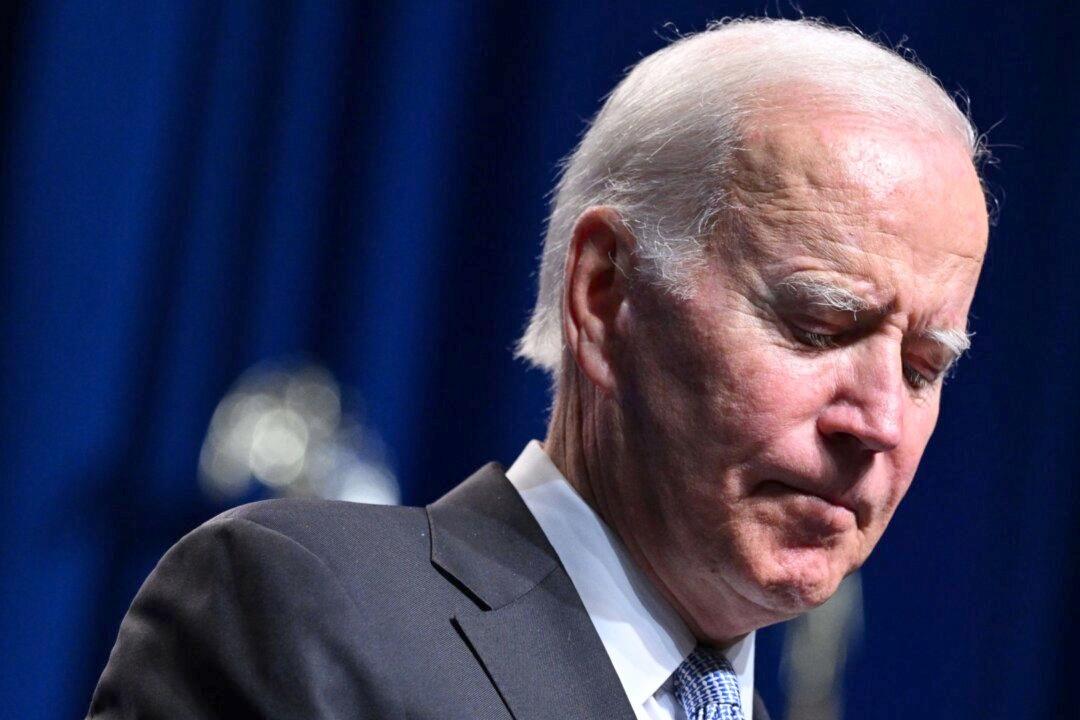

The highly anticipated Nov. 8 midterm elections are a referendum on President Joe Biden and the Democrats, as the Republicans attempt to take back both houses of Congress.