The big news over the weekend was the narrow miss in the assassination attempt on former President (and current leading candidate) Donald J. Trump. Americans of all political persuasions are thankful for his survival, and we grieve the death of an audience member, but when injured candidate Trump raised his fist in defiance against the assassin, that gave new energy to the Republican Convention this week. Prior to last Saturday’s assassination attempt, President Biden and many in the media have repeatedly tried to demonize the “MAGA” Trump crowd, but voters tend to concentrate on the issues, so due to: (1) a lack of upward mobility for many young people, (2) a proposed military draft for men and women up to age 26, (3) open border concerns, and (4) a desire for more law and order, it appears that Donald Trump might be re-elected in a landslide, even if Joe Biden is replaced by a younger, more energetic candidate. Fed Chairman Jerome Powell has been waffling for months about cutting interest rates, and candidate Trump has been very critical of the Fed for the damage they have inflicted on interest rate-sensitive sectors of the U.S. economy. Furthermore, riding a new populist wave, Trump is also expected to reignite the call for lower interest rates, if elected. He also plans to unleash the full U.S. energy sector from Day One and throughout the first 90 days of any new Trump Administration.

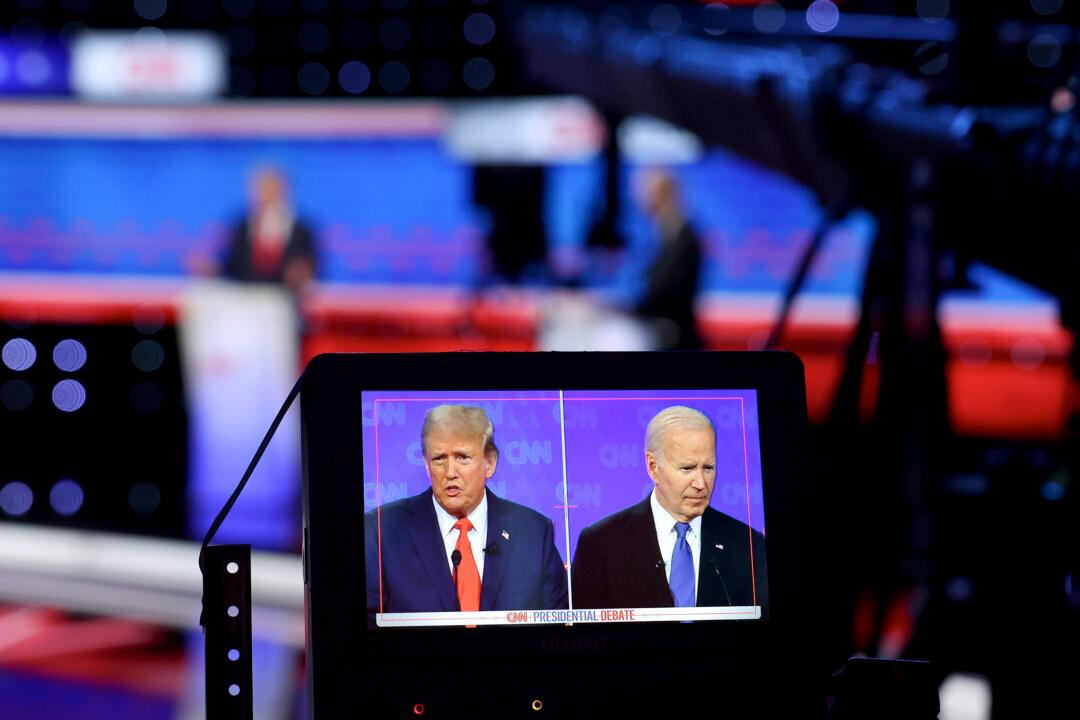

President Joe Biden and former President and Republican presidential candidate Donald Trump participate in the first presidential debate of the 2024 elections at CNN's studios in Atlanta, Ga., on June 27, 2024. Andrew Caballero-Reynolds/AFP via Getty Images

Commentary