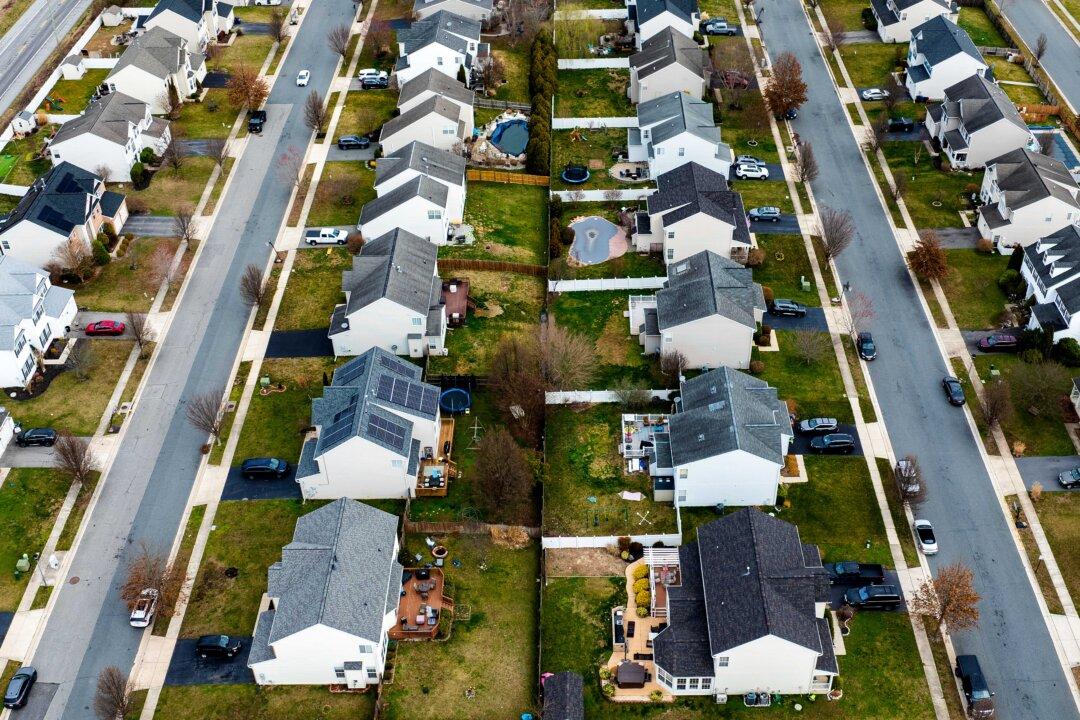

The cost of buying a home is rising swiftly in three Midwestern towns, due to a housing shortage that is triggering bidding wars, according to a new report.

Real estate broker firm Redfin found that the median home sale price in Milwaukee increased by 20 percent year over year in February to $330,000, followed by Detroit at 12.5 percent and Cleveland at 10 percent.