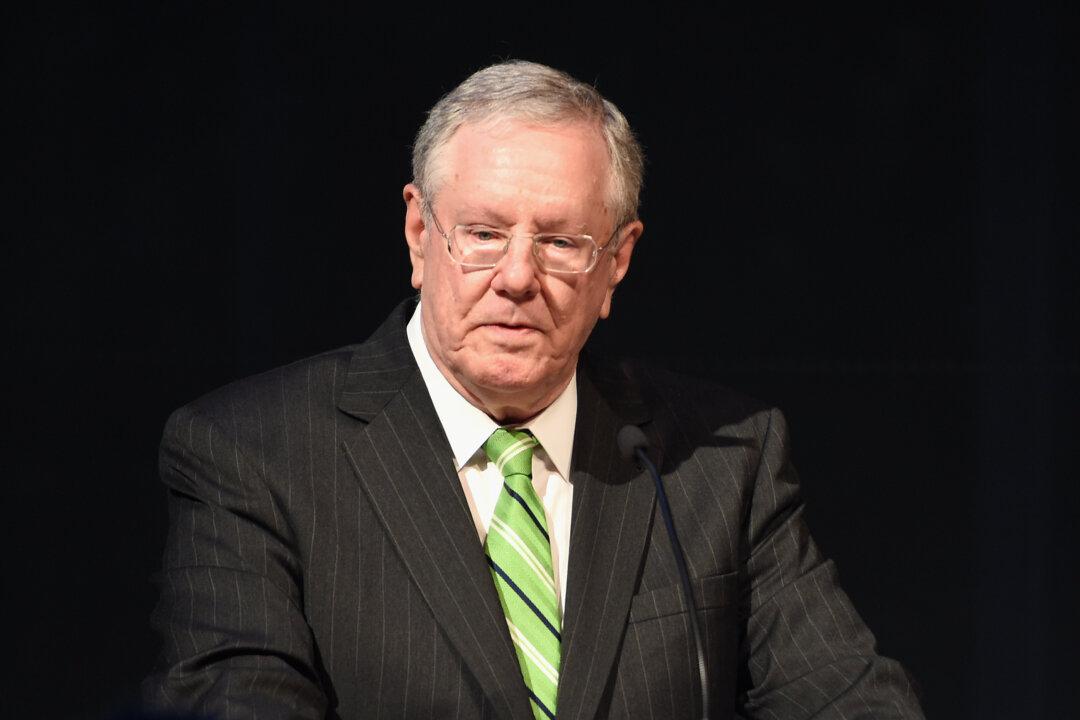

Forbes magazine editor-in-chief Steve Forbes warned that the United States will see economic turbulence next year, claiming a potentially “choppy” ride awaits some Americans.

Mr. Forbes, a former Republican presidential candidate in 1996 and 2000, told Newsmax that he believes the Federal Reserve is erroneously operating under the belief that “prosperity causes inflation” and that coupled with “uncertainty in the marketplace,” the “economy faces serious headwinds on investment.”