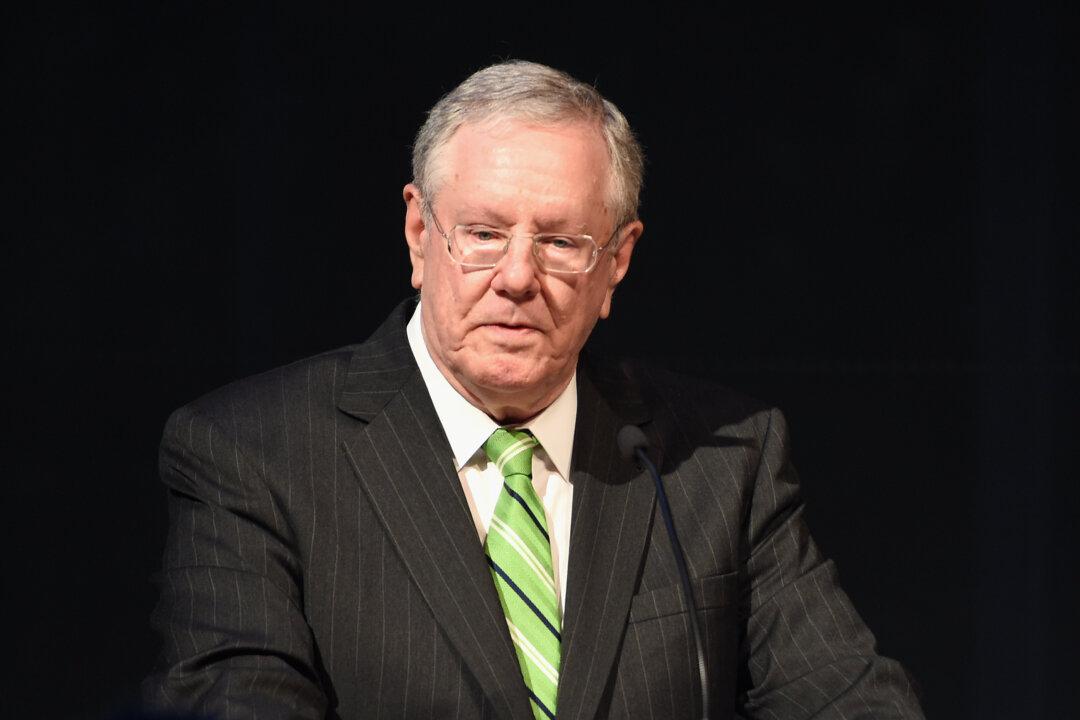

Steve Forbes, chairman and editor-in-chief of Forbes magazine, has claimed that the Biden administration and the Federal Reserve are ignoring the “real cure” of inflation and are instead placing their attention on raising interest rates.

Forbes made the comments at the Forbes Global CEO Conference in Singapore on Monday, CNBC reported, shortly after the U.S. central bank raised its benchmark interest rate by 75 basis points for the third straight month.