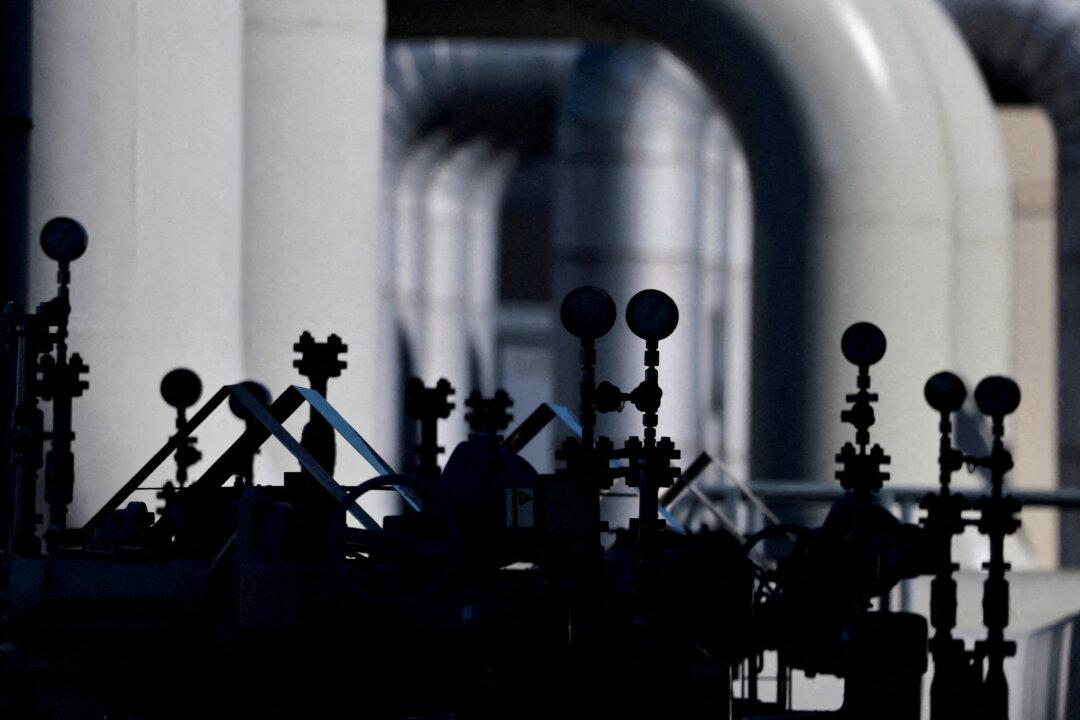

Soaring energy costs continue to hit Europe hard this week, as governments in the region are struggling to contend with the rising cost of energy, after Russian gas was drastically cut earlier this month.

Russia cut natural gas and oil exports to Europe after the European Union, the United Kingdom, and the United States placed sanctions on Russia for its invasion of Ukraine.