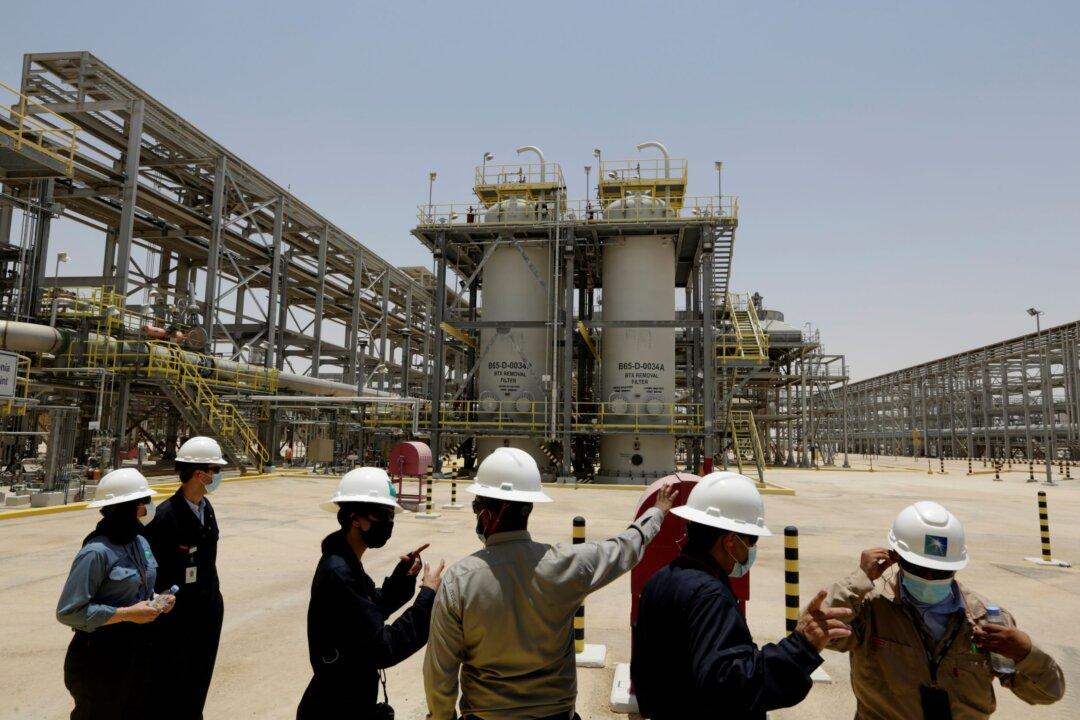

Saudi Arabia’s state oil company Aramco on March 20 pledged to increase the amount it invests in oil production after it reported that profits more than doubled year-on-year to $110 billion.

The world’s largest oil exporter said its net profit increased by 124 percent to $110 billion in 2021, compared with $49 billion a year prior.