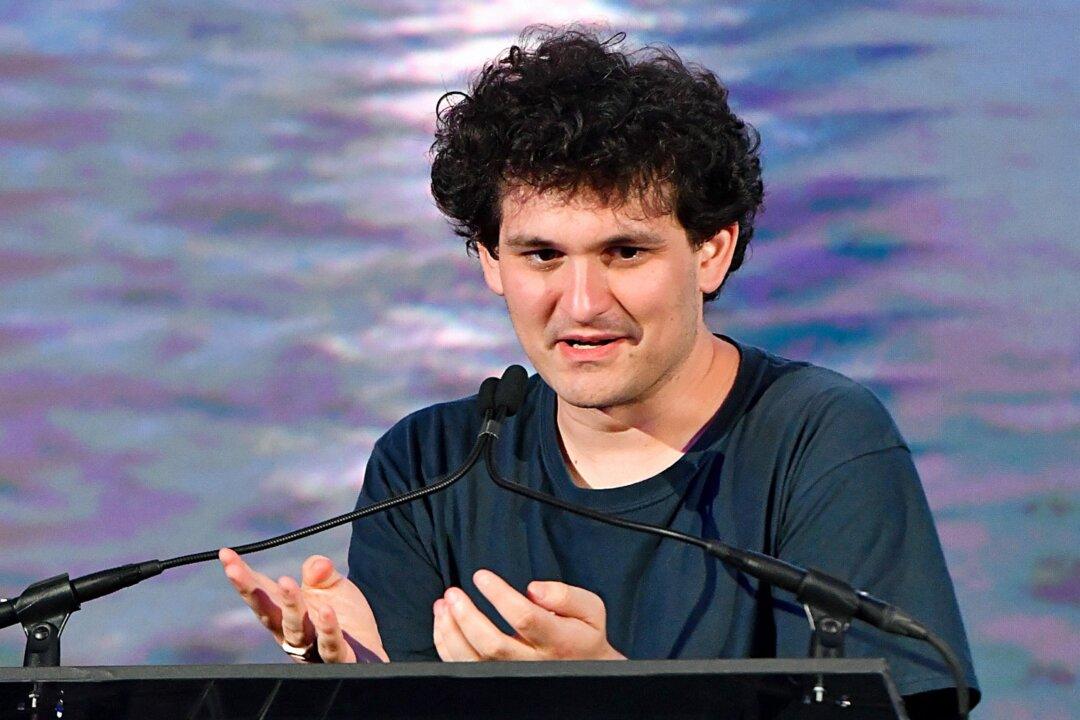

Sam Bankman-Fried, the former CEO of the bankrupt crypto exchange FTX, has dismissed the notion that users of the platform will not recover anything substantial from the collapsed firm.

In an interview with YouTube commentator Tiffany Fong, Bankman-Fried said that FTX U.S. will get “a dollar on the dollar” and that international users can expect to get “20 to 25 cents on the dollar” as recovery. FTX had filed for bankruptcy in November after concerns about the company’s balance sheet triggered a rush of withdrawals, pushing the firm into a liquidity crisis. According to the company, more than a million creditors might be affected by the collapse.