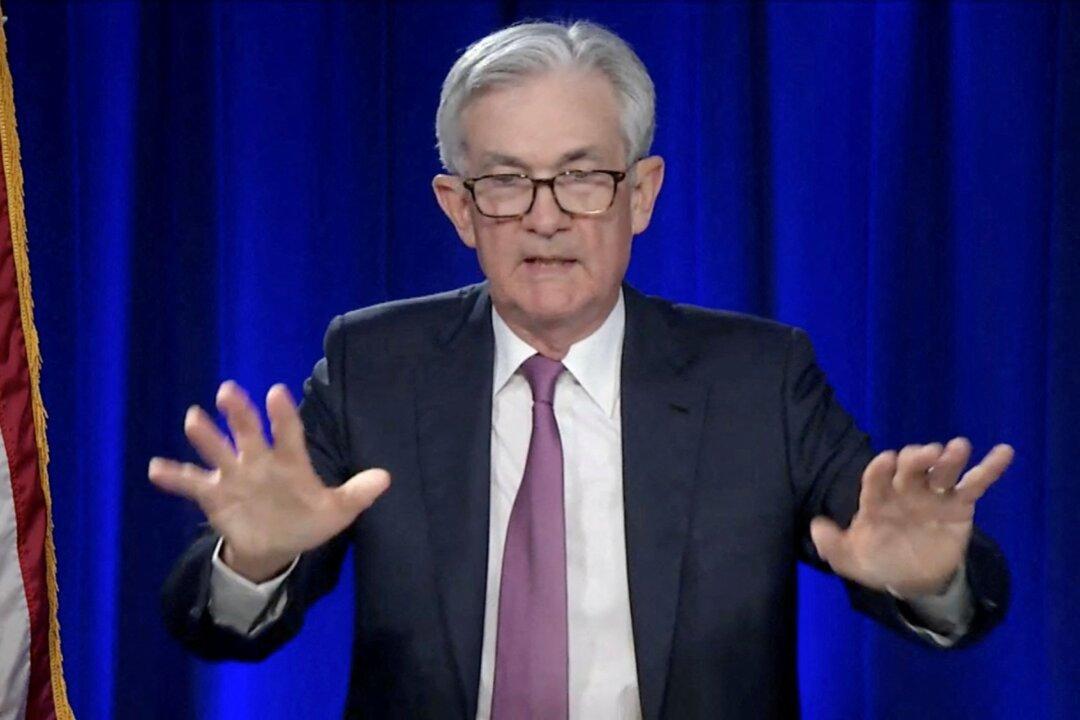

Federal Reserve Chairman Jerome Powell said on Monday that the central bank is prepared to take more aggressive measures to stabilize prices if necessary, as rampant inflation continues amid a relatively strong labor market.

During an address to the National Association for Business Economics on Monday, Chairman Powell gave his strongest message about inflation to date, stating that he is prepared to “take the necessary steps to ensure a return to price stability” as inflation persists.