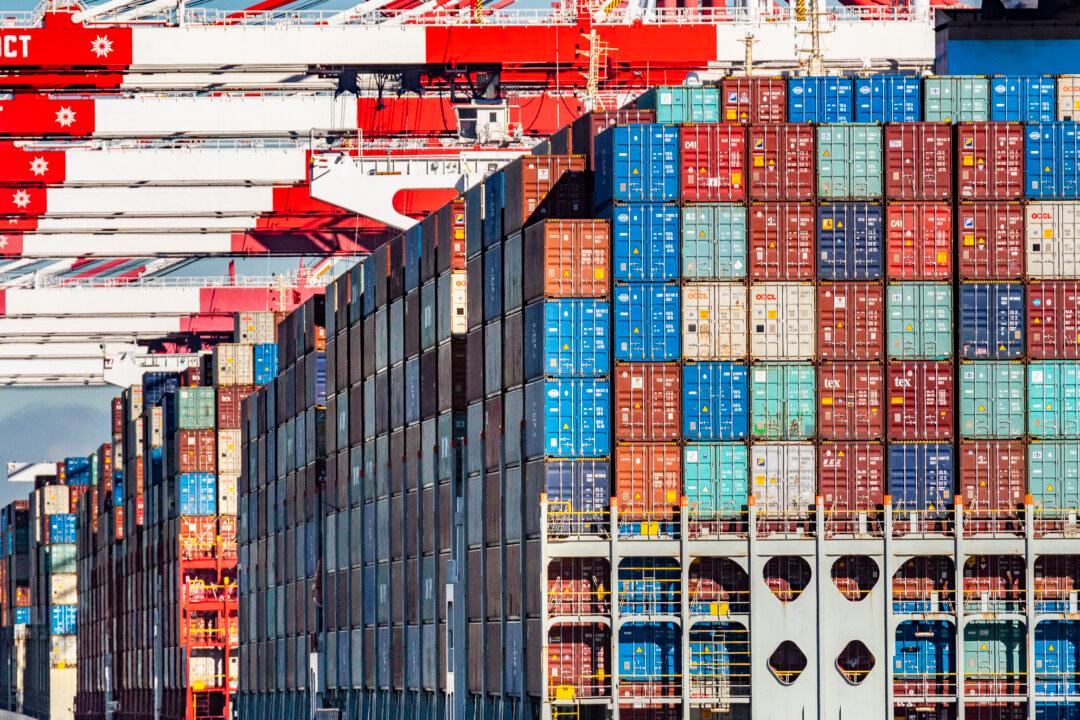

Omicron outbreaks have exacerbated shipping congestion across the globe, with major Chinese and U.S. ports affected. Experts forecast that supply chain bottlenecks will continue into at least the second half of this year.

With a fresh wave of COVID-19 outbreaks spreading in China, Chinese Communist Party (CCP) officials have launched mass lockdowns and testing, driven by the central government’s “zero-COVID” policy. Consequentially, major manufacturers have closed their plants, triggering labor shortages and blockages at ports. Economists warn the potential impact of the current pandemic could be alarming as more challenging bottlenecks are likely to surface in the future.