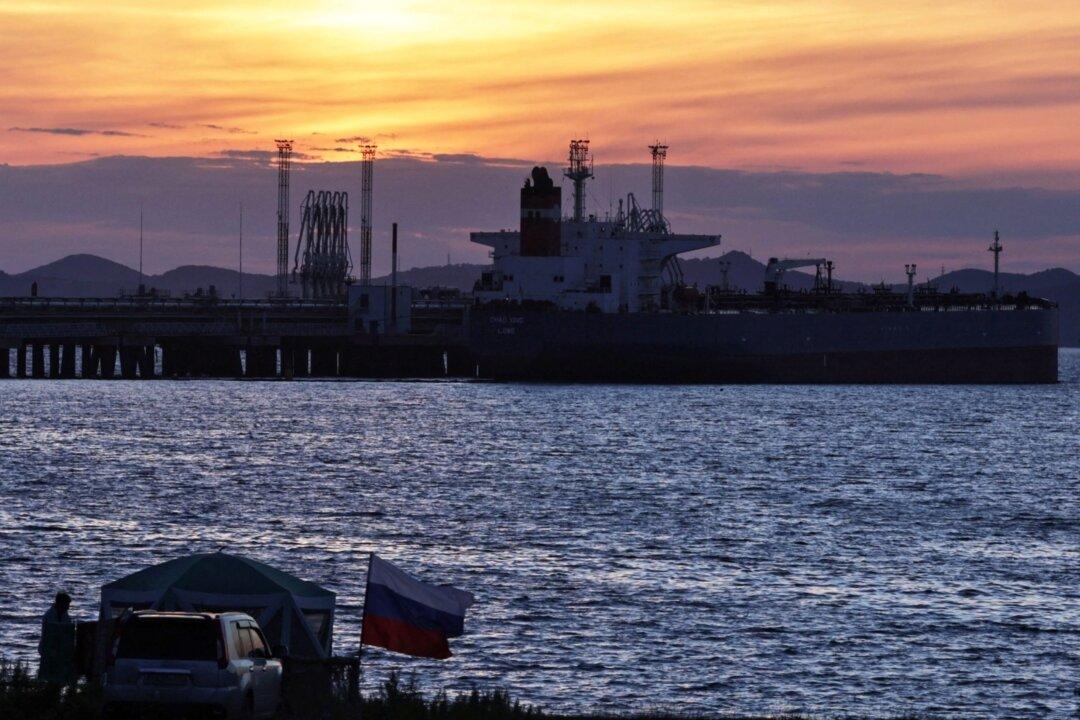

LONDON—Oil rebounded on Thursday after four sessions of decline, boosted by hopes that easing anti-COVID measures in China will revive demand and by signs that some tankers carrying Russian oil have been delayed after a G7 price cap came into effect.

China on Wednesday announced the most sweeping changes to its resolute anti-COVID regime since the pandemic began, while at least 20 oil tankers faced delays in crossing to the Mediterranean from Russia’s Black Sea ports.