The industry group representing America’s oil industry slammed President Joe Biden’s recent statements threatening windfall taxes and restrictions on oil companies.

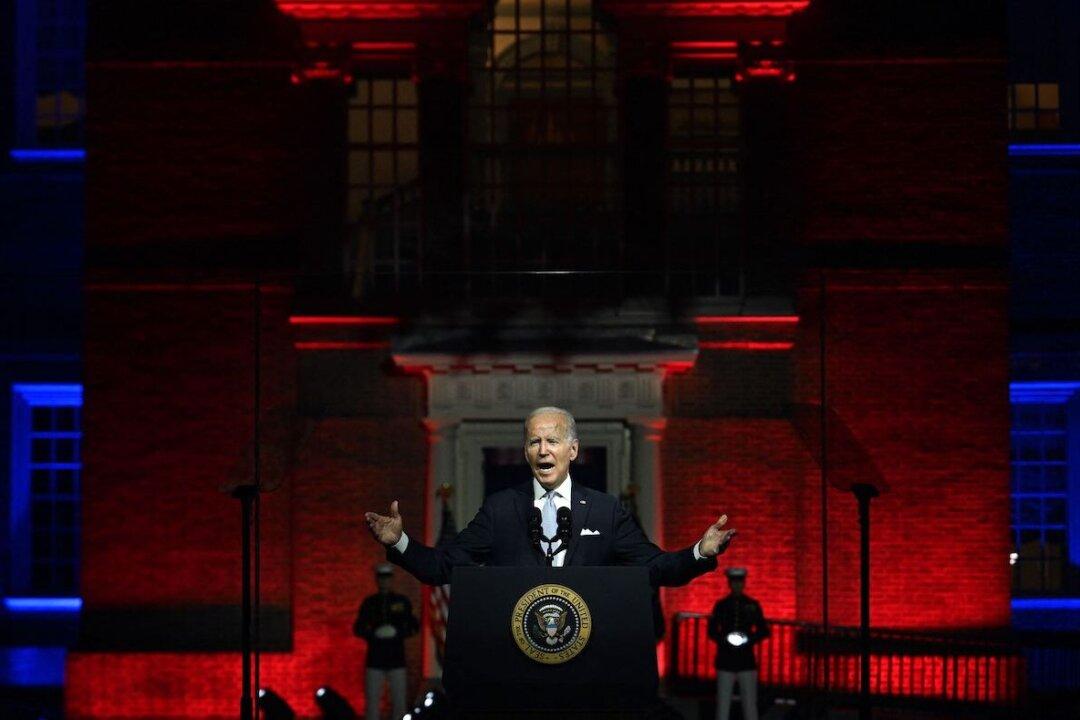

Biden attacked major U.S. oil companies at a White House press conference on Oct. 31, instructing them to invest more into boosting domestic oil production and to lower consumer prices—or else face possible restrictions.