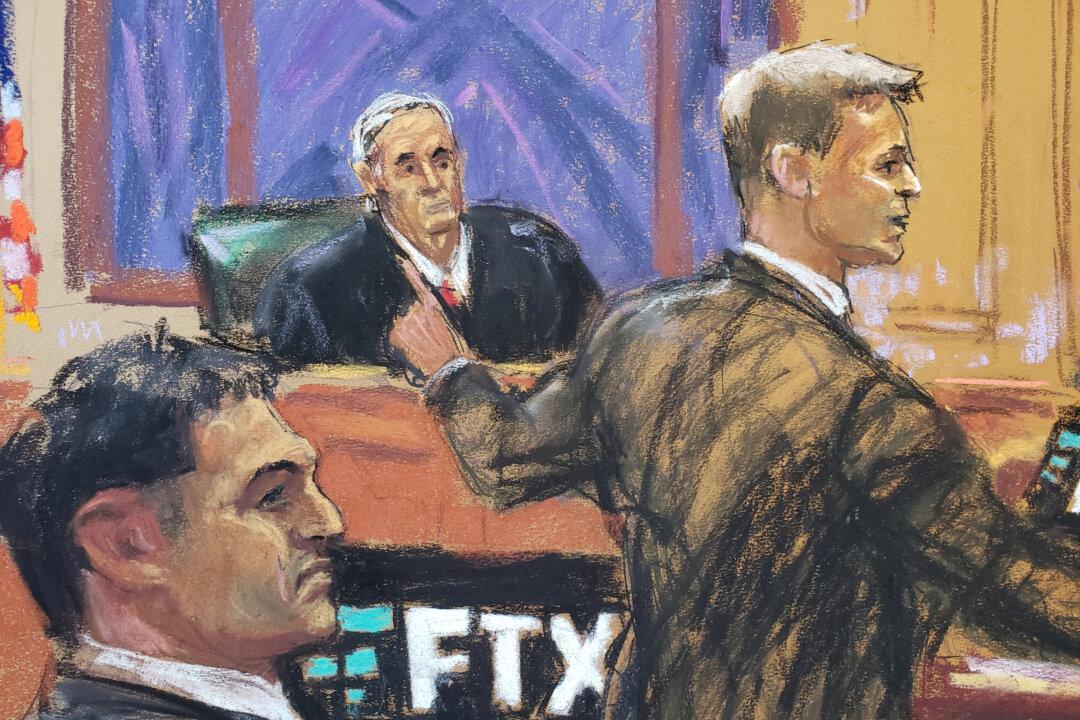

Former FTX co-founder Gary Wang testified over the past week that what co-founder and CEO Sam Bankman-Fried said was a market-making service for traders on the cryptocurrency exchange soon became a means of siphoning off customers’ money for speculation at Alameda Research, a sister-company crypto hedge fund.

Testifying before a New York jury, Mr. Wang, who had been FTX’s chief technology officer, as well as a college roommate and longtime friend of Mr. Bankman-Fried, said FTX affiliate Alameda Research was given the ability to borrow money from FTX accounts starting in July 2019, without customers’ knowledge or consent.