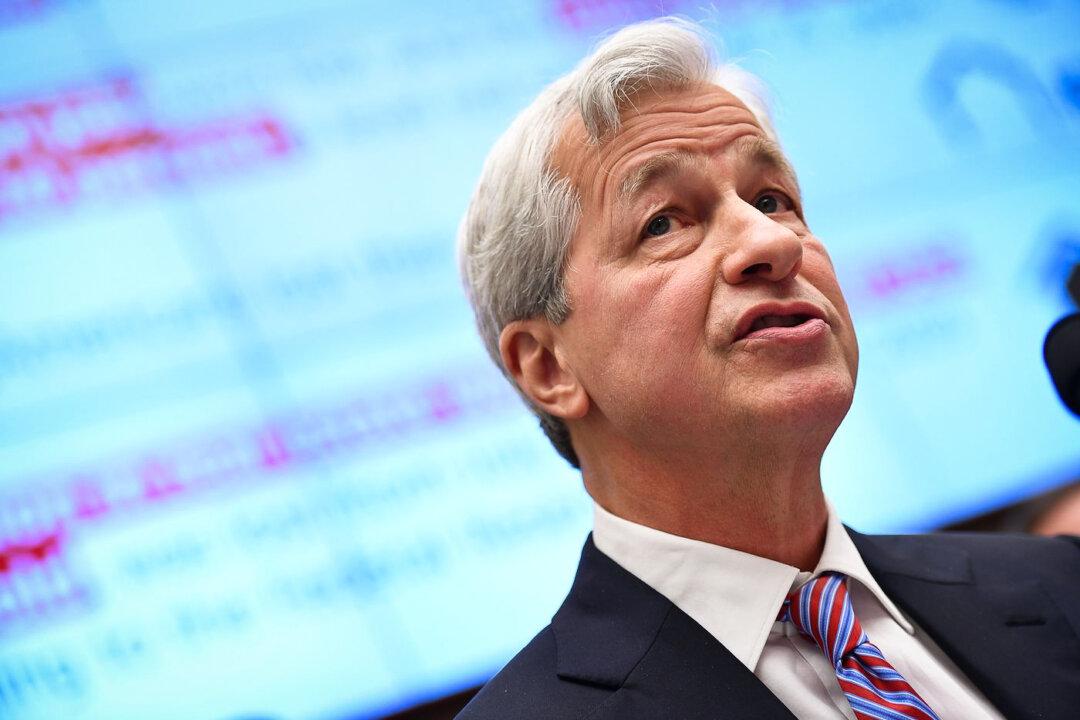

JPMorgan CEO Jamie Dimon has warned that interest rates could top 8 percent, with his grim prediction coming as the latest economic data show inflation rising.

Mr. Dimon made the remarks in his annual letter to shareholders on April 8, in which he cautioned about the prospect of inflation staying higher for longer, while expressing worry that the forces of deglobalization and the Biden administration’s ongoing deficit spending were exacerbating price pressures.