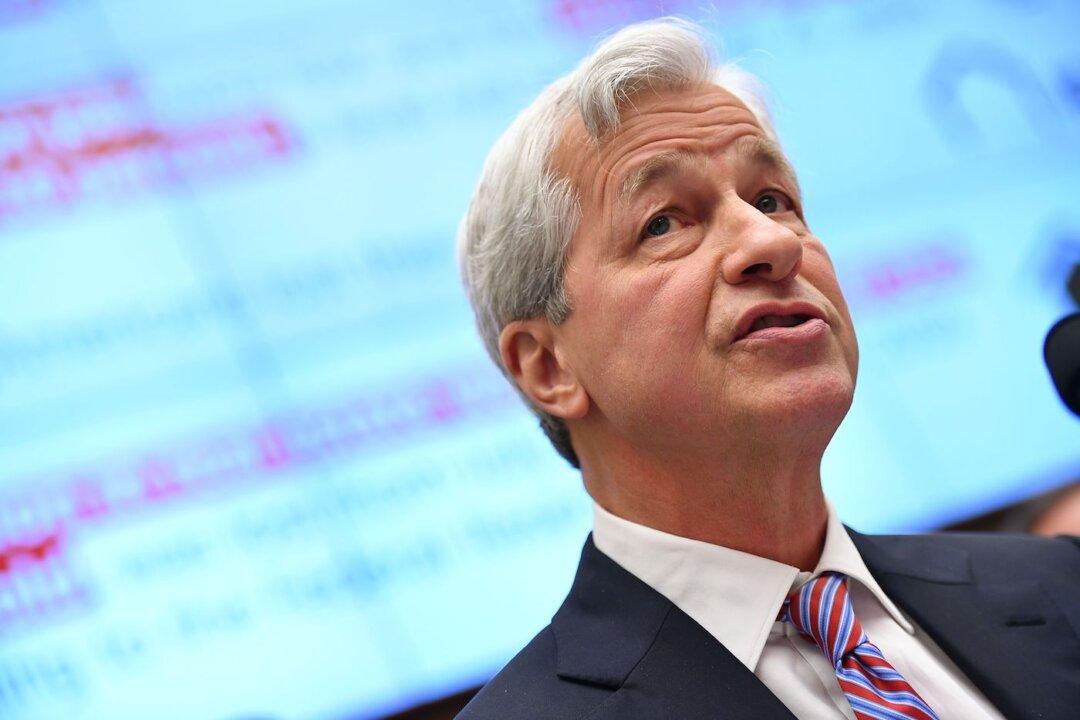

Despite the international community’s pledge to depend on renewable energy to achieve its net-zero emissions goal by 2050, the world will need oil and gas for the next 50 years, according to JPMorgan Chase CEO Jamie Dimon.

While speaking in an interview with CNBC in Davos, Switzerland, on Jan. 19, Dimon warned that if the global economy abandoned fossil fuels altogether, there would be a “calamity” and “global depression.”