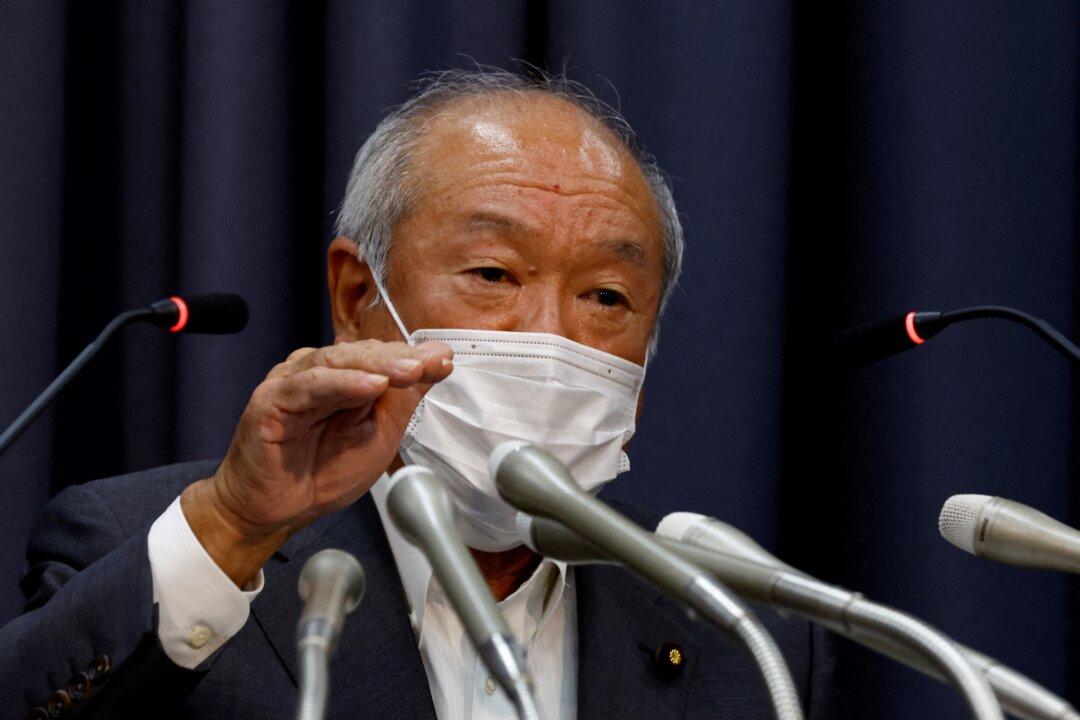

TOKYO—Japan’s finances are becoming increasingly precarious, Finance Minister Shunichi Suzuki warned on Monday, just as markets test whether the central bank can keep interest rates ultra-low, allowing the government to service its debt.

The government has been helped by near-zero bond yields, but bond investors have recently sought to break the Bank of Japan’s (BOJ) 0.5 percent cap on the 10-year bond yield, as inflation runs at 41-year highs, double the central bank’s 2 percent target.