Commentary

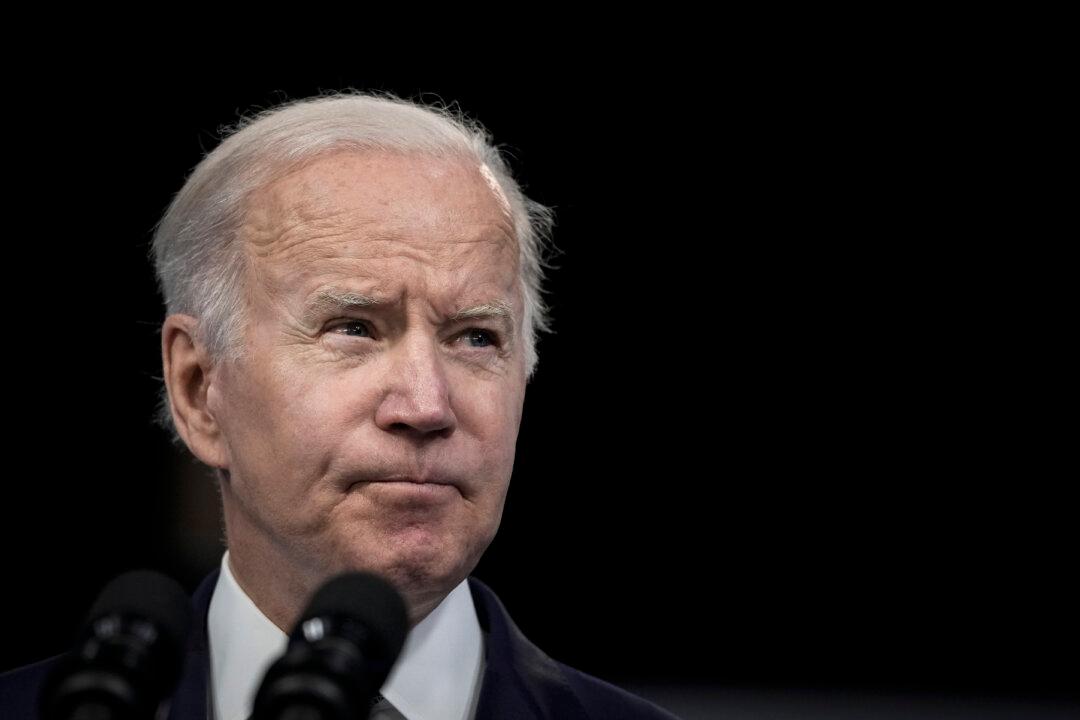

NEW YORK—The biggest economic news of the year, so far, has been inflation—the highest in 40 years—and the Federal Reserve’s (Fed’s) efforts to fight it. And while there have been lots of finger-pointing at causes—from President Joe Biden’s fossil fuel policies to the war in Ukraine—all of which are at least somewhat true—there are myriad other causes that the media tends to ignore and that we need to address to tamp down the current inflation and avoid it in the future.