Over the past three years, household wealth has surged because of a combination of higher stock market returns, rising property values, and pandemic-era fiscal stimulus. However, new research indicates that rampant price inflation has nearly erased all of these gains.

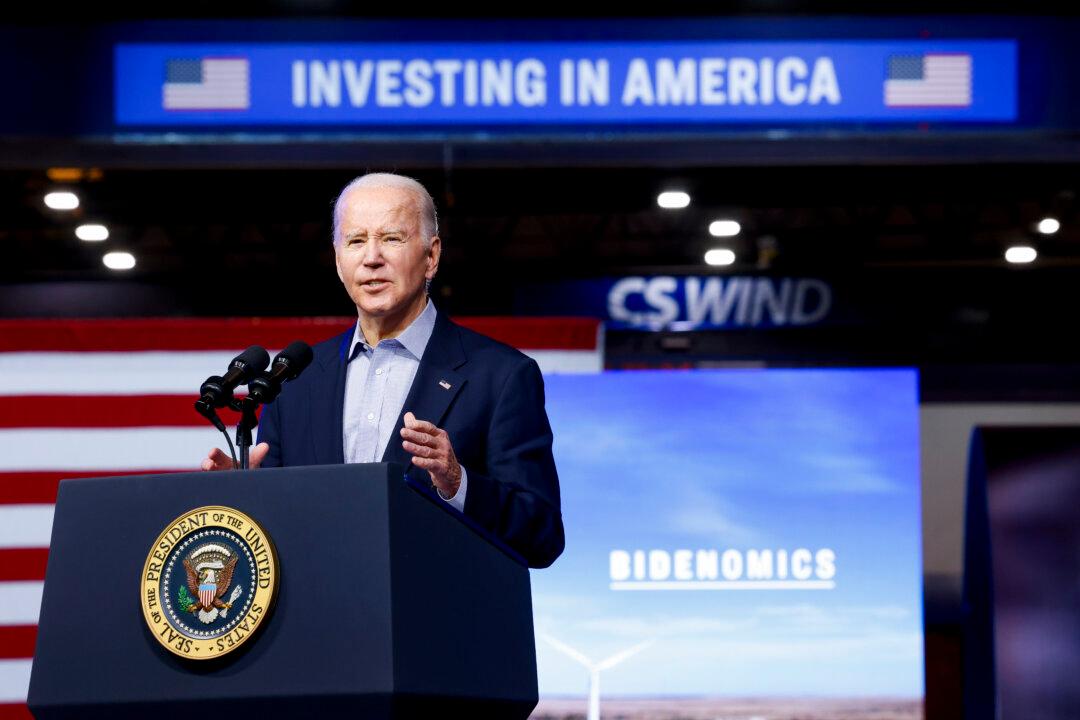

The Wall Street Journal recently published an analysis, shared by George Mason University professor Todd Zywicki on social media platform X, that assessed changes in U.S. household net worth, from cash and stocks to bonds and property, under Presidents Joe Biden and Donald Trump.