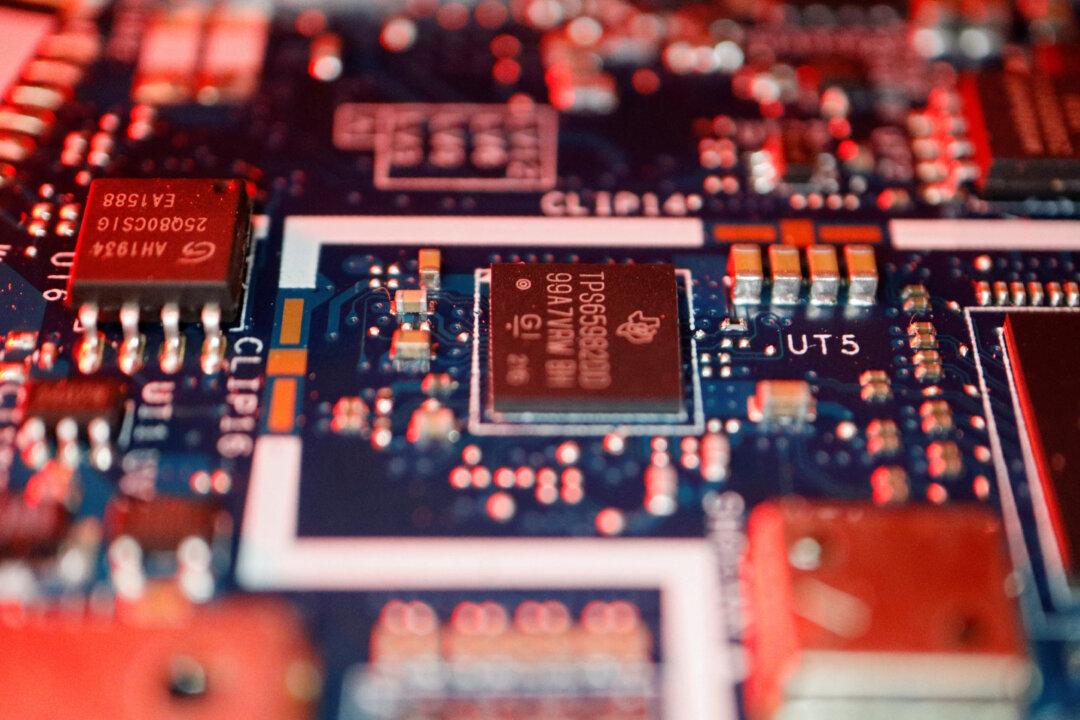

The U.S. government enacted a massive bill earlier this year directing more than $52 billion in federal investment into semiconductor research and manufacturing, with the goal of strengthening local supply chains and countering China’s rising clout in the important high-tech sector. But an industry group is calling for tens of billions in additional funding, saying more investment is needed to shore up America’s flagging dominance of chip design.

In a recent report (pdf), the Washington, D.C.-based Semiconductor Industry Association (SIA) and the Boston Consulting Group argued that federal investment of around $20–30 billion in chip design and research and development (R&D) through 2030 will help the United States maintain its current leadership of the semiconductor design industry. That sum includes $15–20 billion for an investment tax credit focused on chip design.