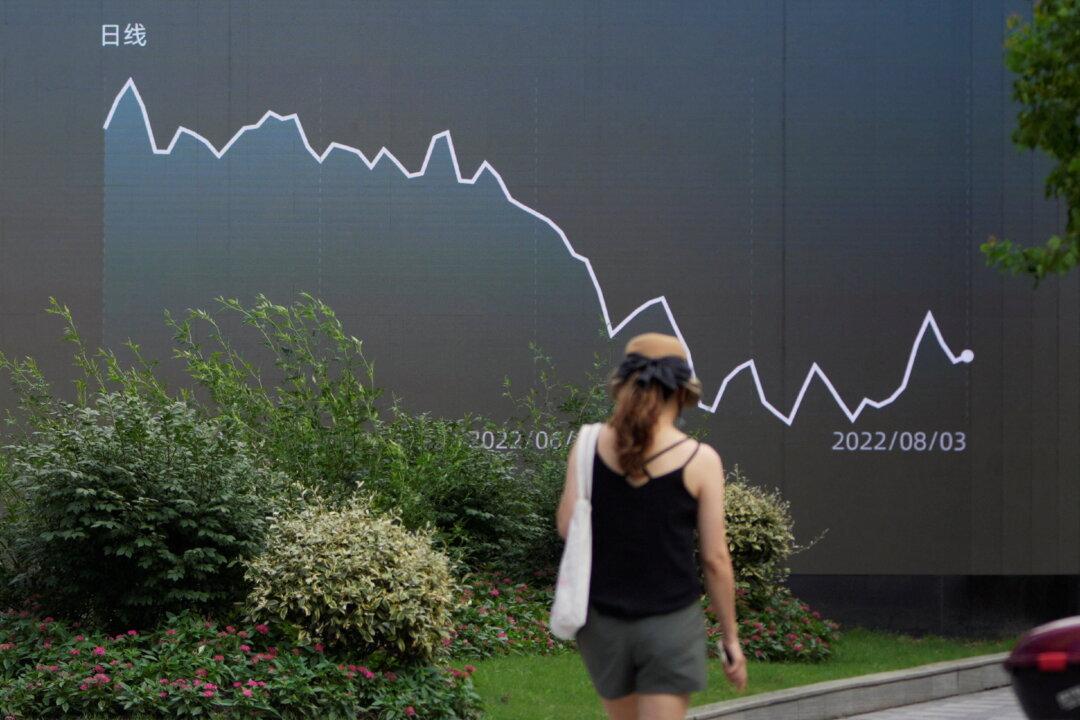

LONDON—Global stocks were stuck near five-week lows on Tuesday as rising government bond yields unnerved investors, while rate cuts from China and disappointing data underscored the economic malaise gripping the world’s second biggest economy.

Emerging markets remained in focus a day after Argentina devalued its currency by nearly 18 percent, while Russia’s central bank on Tuesday raised interest rates by 350 basis points at an extraordinary meeting following a fresh slide in the ruble.