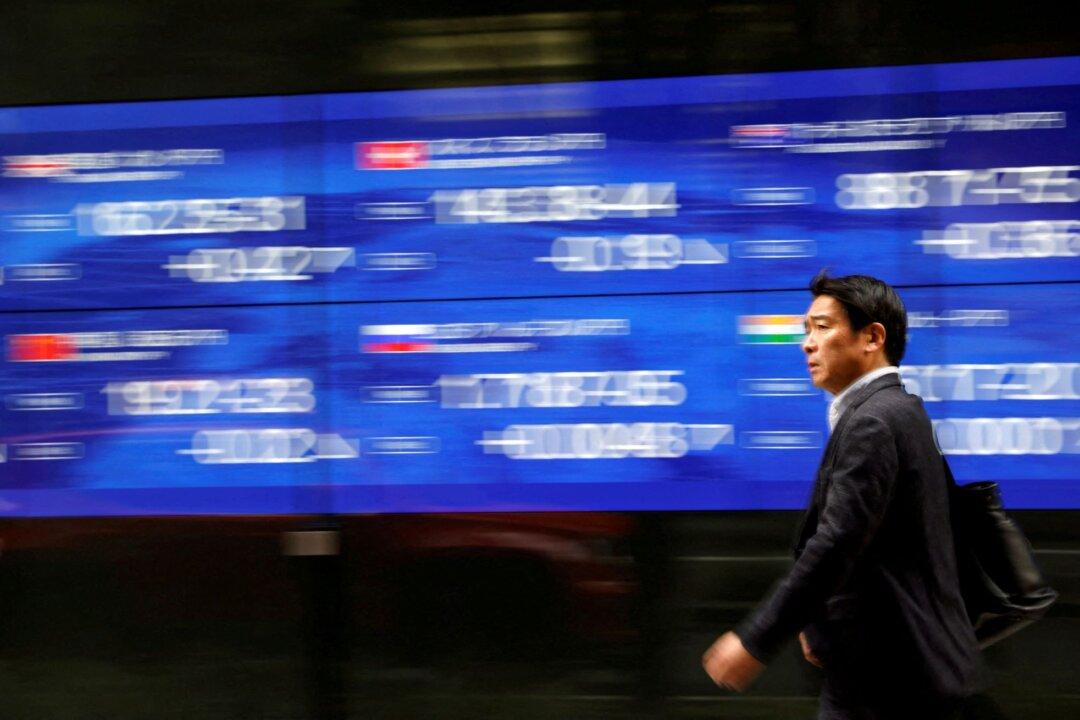

LONDON—A stagnant German economy and sliding yen overshadowed buoyant tech earnings to send shares lower on Friday, with investors betting that next week’s batch of central bank meetings will point towards a levelling off in interest rates.

Oil headed for a second week of declines after data on Thursday showing the U.S. economy slowing more than expected in the first quarter.