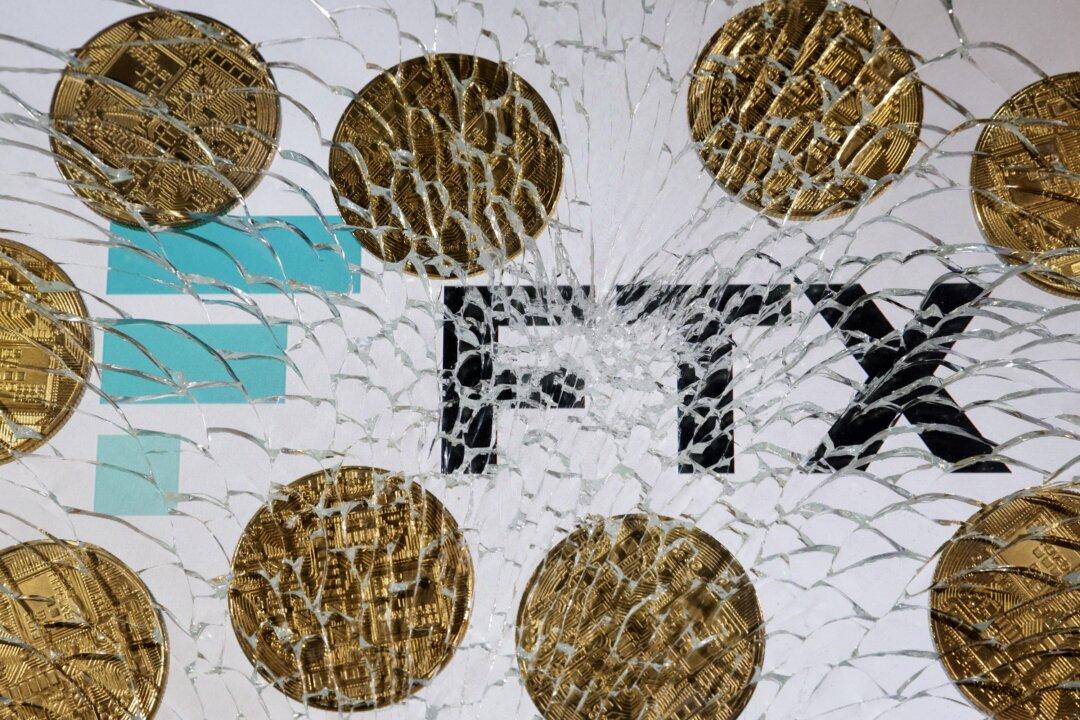

Failed crypto exchange FTX Trading Ltd. lacked a control framework, and collapsed due to “hubris, incompetence, and greed,” according to a new review of FTX, which mentioned that the previous management “stifled dissent” and “joked internally about their tendency to lose track of millions of dollars in assets.”

The review was published as an interim report on Sunday by the new FTX CEO John J. Ray III and a list of more than a hundred debtors, FTX-affiliated or related companies, such as Alameda Research Ltd. and FTX Europe AG.