The Federal Reserve left interest rates unchanged at the first policy meeting of 2024, signaling that officials might not reduce the benchmark federal funds rate “until there is greater confidence” that inflation is inching toward the central bank’s target rate of 2 percent.

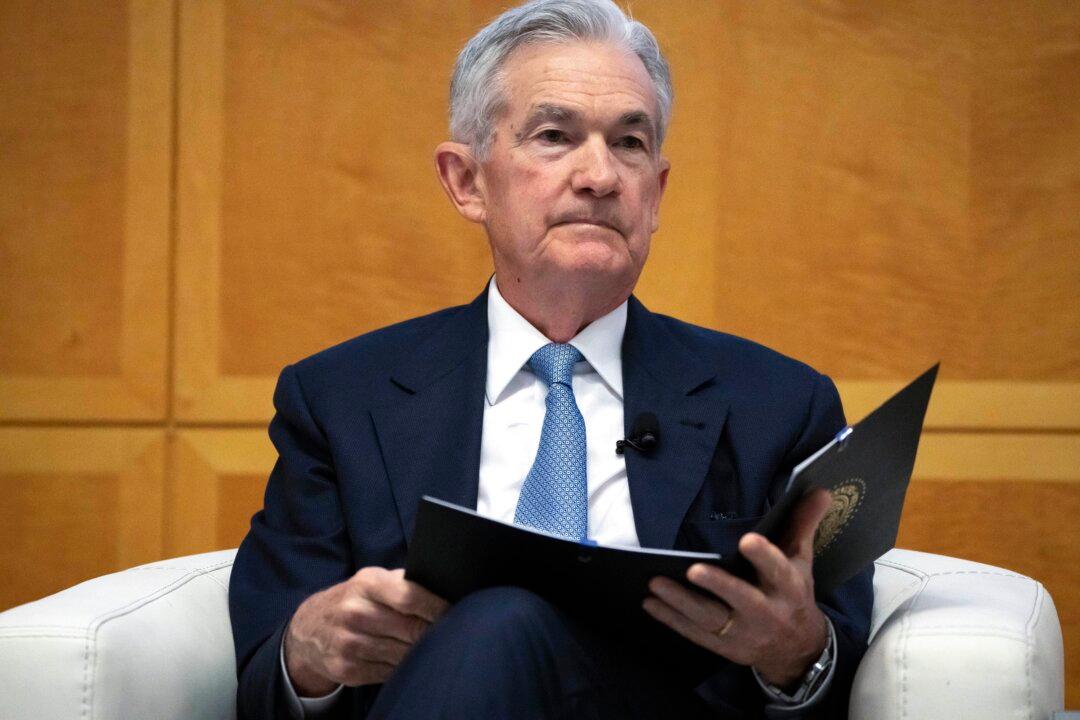

It’s unlikely that the central bank will pull the trigger on a rate cut in March, Fed Chair Jerome Powell told reporters during the post-Federal Open Market Committee (FOMC) meeting news conference.